Working through retirement: Strategies for the working retiree

Australians are retiring at the highest average age since the early 1970s, indicating a significant change in labour market trends. This has been largely driven by work in ‘knowledge–intensive’ roles (e.g., board or advisory positions) which has seen more Australians reshape what ‘retirement’ looks like for them. We continue to see a trend of more Australians continuing to work in some format after leaving full-time work. Individuals in this semi-retired bucket can unlock a range of strategies to enhance financial and estate planning outcomes.

Australian retirement trends

Estimates from Treasury show that 1.6 million Australians aged 65 and over are currently drawing income from their super, with this number set to more than double to 4.1 million over the next decade. This demographic shift is also accompanied by changing attitudes toward retirement, with many reconsidering traditional notions of leaving the workforce and staying retired. Data from AustralianSuper shows that up to one in five members who are drawing from their superannuation (i.e., retired) are still engaged in paid work.

Strategies for those that are retired and employed

As an individual benefiting from the concessions of retirement while continuing to accumulate via employment, there are a range of strategies that can be used to build and preserve wealth tax-effectively.

As a summary of such strategies, individuals can consider:

- Commencing a pension: Once retired, and provided select eligibility criteria are met, a pension may be commenced on a superannuation balance. The tax rate on funds in pension phase is 0%, compared to the 15% tax rate on funds in accumulation phase. This eliminates tax on investment earnings and provides a tax-free income stream. More importantly, this does not prevent ongoing or future work from being undertaken. A detailed overview of this is available here.

- Withdrawal and re-contribution: As the name suggests, this involves withdrawing monies from superannuation and contributing them back to your fund. The purpose of this strategy is to increase the proportion of your fund that is considered tax-free, thereby improving estate planning outcomes for certain beneficiaries (i.e., reducing estate tax payable). A detailed overview of this is available here.

- Downsizer contribution: For those selling their family home, a downsizer contribution allows for a one-off contribution of $300,000 per person. This strategy benefits from more flexible eligibility criteria than regular contributions and does not impact other contribution caps. A detailed overview of this is available here.

- Ongoing contributions: For those who are working, they are provided additional flexibility to make concessional (before-tax) contributions, which help reduce tax. This includes:

- Super guarantee and employer mandated contributions: No age restrictions.

- Salary sacrifice arrangements: Available until age 75.

- Personal concessional contributions: No restrictions before age 67. Between the ages of 67 and 74, individuals must meet a work test or qualify for an exemption.

Enhanced retirement and happier beneficiaries

Australia boasts one of the highest life expectancies globally, and as this increases, there is a growing need for retirement savings to stretch further. Data from AustralianSuper shows that amongst their members, up to 40% of a retiree’s superannuation earnings are generated once in pension phase (i.e., once retired). This is a reflection of a higher capital base at retirement and highlights the importance of reducing outflows, such as tax (by commencing a pension), and preserving additional wealth for beneficiaries by reducing estate tax (via withdrawal and recontribution strategies). Furthermore, there is merit in continuing to build one’s asset base in retirement.

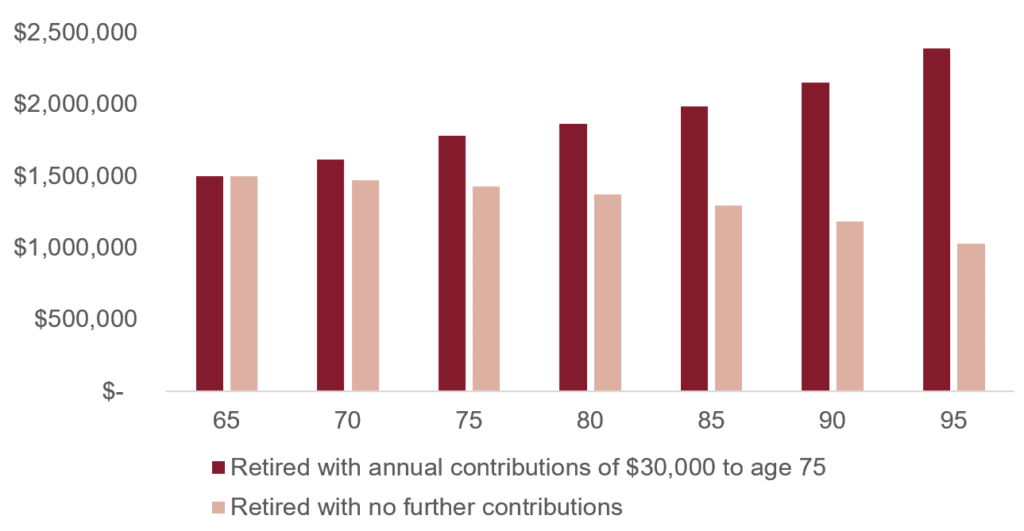

In the example below, we look at Claudia, a recently retired accountant aged 65. Claudia has a superannuation balance of $1.5 million and withdraws $110,000 annually to fund her lifestyle in retirement. Owing to Claudia’s experience, she has been offered a paid role on the board of national accounting business. As the graph below demonstrates, if Claudia were to work in this capacity over the next 10 years (contributing $30,000 to superannuation annually), her retirement savings would grow even as she continues to withdraw funds. By age 95, the difference in Claudia’s superannuation balance would be over $2.3 million, despite only contributing an additional $300,000.

Source: E&P

*An investment return of 7% is based on an Evans and Partners Model Portfolio 7 which targets a return of CPI +4.5%.

Overview

As more Australians elect to continue working, there will be additional opportunities to consider from a financial planning perspective. An Evans and Partners financial adviser can help assess the suitability of each strategy to your unique goals, objectives, and personal circumstances to ensure your employment income strengthens your broader financial and estate planning position.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.