Why you can’t set and forget in a changing rate environment

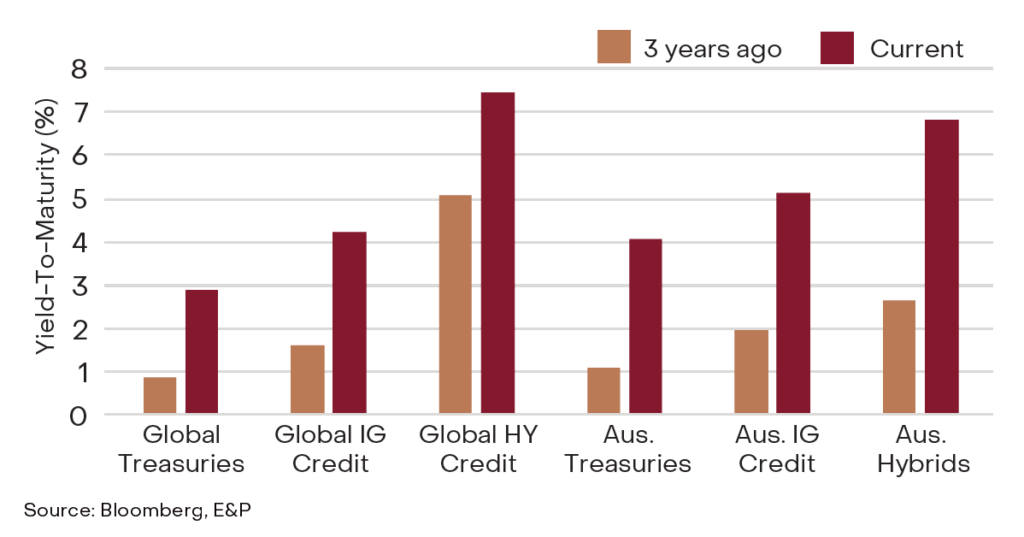

The global fixed income universe remains a valuable haven for client capital thanks to defensive and sustainable sources of yield from a diverse range of underlying asset types. That’s not to say investors and allocators can simply ‘set and forget’ their allocation to defensive assets. The interest rate environment is ever changing and this is having a profound impact on the relative attractiveness and underlying risk profiles of respective sub-asset classes.

For instance, Australian government bonds and long duration credit instruments have recently been beneficiaries of the growing expectation that domestic policymakers will shortly follow in the footsteps of most global central banks and embark on a new rate cutting cycle. Current market implied pricing assumes three and a half 25bps cuts in the official cash rate by July next year. We share a different view, instead opining that the resilient Australian labour market, sticky domestic inflation trends, and lower interest rate starting point means the start of a modest RBA rate cutting cycle is a story for the midpoint of 2025.

Fixed Income Yields

Yield-to-maturity, current vs. 3-years ago

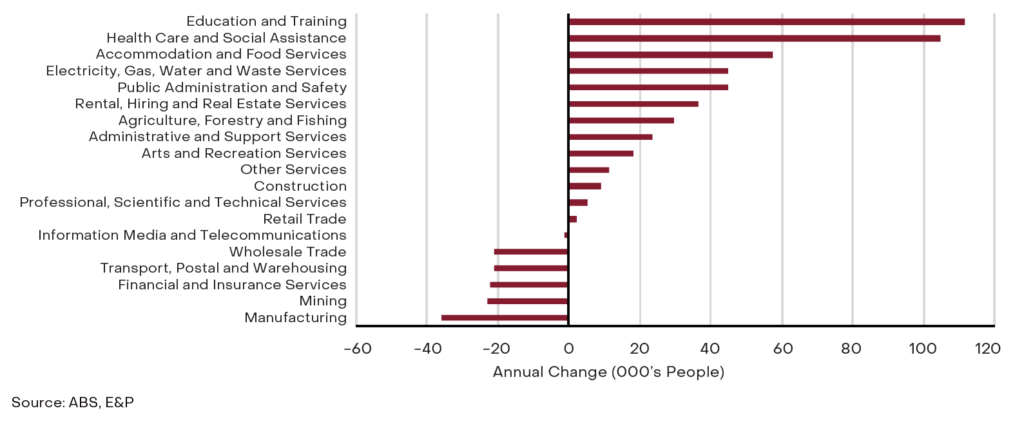

The RBA’s own Chief Economist Sarah Hunter recently explained there’s no room for rate cuts until the labour market substantially weakens. This looks increasingly unlikely, particularly given government spending initiatives such as the National Disability Insurance Scheme (NDIS), which is driving jobs growth and above-trend wage inflation in non-market sectors such as healthcare, education and public administration. We expect local interest rates will remain on hold for at least another 6-12 months before the RBA embarks on a slow and methodical easing cycle, wary of the threat of a re-acceleration in core inflation.

As a result, we anticipate local bond yields will trend higher as rate cut expectations are pared back, putting pressure on fixed rate exposures such as government bonds. Instead, floating rate credit instruments such as subordinated debt and major bank hybrids look a more optimal destination for client capital given attractive all-in yields, solid underlying fundamentals and strong primary and secondary market support from yield conscious retail and institutional investors.

On the latter, we recently learned APRA intends to phase out Australian banks’ use of hybrid capital, concluding the high ownership of them among retail investors is a risk to financial stability, and instead wants to “simplify and improve the effectiveness of bank capital in a crisis”. Instead, APRA is proposing that banks replace the $43 billion of ASX-listed hybrids with a combination of common equity and tier-two bonds, which rank above equity but below senior debt in the capital structure. While the proposal is now open for discussion and feedback from market participants is welcomed, we get the sense that the prudential regulator will push ahead with the initiative, effectively banning any new issuance from 2027 and abolishing the market by 2032.

As a result, we think income focused investors will have to turn to alternative sources of yield in the years ahead to supplement existing hybrid holdings. High yielding credit strategies such as private debt, real estate financing and asset backed lending, look well placed to benefit from this development, however investors must be acutely aware they may be taking on increased credit, illiquidity and structuring risk when doing so. In our recently published “PRG Year in Review FY24” we detail the strict selection criteria we apply when assessing managers in these areas and highlight some of our preferred strategies in the space.

Australian Employment Growth by Industry

August 2023 – August 2024

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.