Could Small Caps Could Benefit From a Market Bounce?

Valuations for the Australian small cap sector have recently fallen close to decade lows and could provide opportunities for investors to buy-in. We take a closer look at the market and some of the factors to consider.

A global comparison

E&P Chief Investment Officer, Tim Rocks says the sell-off has impacted Australian small caps more than their global counterparts ― but there are a number of reasons why this has occurred which offers some valuable context.

He says: “In the US, market indices and valuations have been largely driven by movements with the FAANG stocks, so mid caps will be less vulnerable to a valuation correction ― whilst in the UK, mid caps provide a greater exposure to the domestic recovery and currency upside.

This is why the small cap part of the Australian market stands out. Currently, it presents opportunities where investors can be rewarded if they look through short-term concerns and focus on the potential for stronger long-term returns.” he explains.

The upside of the downside

Small caps have been particularly affected by this selloff, far more than in previous episodes and Rocks believes the sector is well positioned to outperform once markets turn for several reasons.

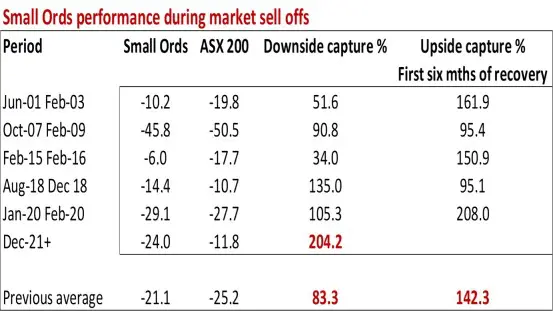

- The ‘small ords’ – the small cap component of the Australian stock market – has fallen by double the overall market i.e. -24 per cent versus almost -12 per cent since December, whereas in previous market selloffs, on average the small ords fell by less than the market.

- The “downside capture” this time is 204 per cent versus the historical average of 83 per cent, which now seems to be reflected in valuations.*

- The price to earnings ratio for the small industrials has fallen to 12 times, excluding resources, and has only been lower in the depths of the global financial crisis and the 1990 recession. Small companies appear to be priced for a severe recession ― however, the gap between large cap and small cap valuations is close to record highs.

- Small caps have also historically had high betas to a recovery. They have had more “upside capture” in the first six months of a recovery i.e. 142 per cent, than “downside capture” in the sell off. Given the lower starting point, this could be even larger this time around.*

Assessing investment opportunities

Rocks says a key consideration when assessing investment opportunities is that the small cap sector has historically outperformed during market recoveries and businesses with strong underlying fundamentals could deliver healthy returns.

He says: “This is where it pays to take a deep dive into what’s driving a business ― such as its competitive advantage, the size of the addressable market, funding structures and the quality of its management team.”

“However, with around 2000 Australian small caps listed on the ASX, undertaking this level of research across the sector is a substantial task for most investors ― and one which can be effectively handled by a specialist manager in the space.” he adds.

Looking ahead

Rocks says based on current market conditions, increasing exposure to small caps now seems to be a good way to start positioning for a market bounce.

He says: “The upcoming reporting season will be an important event and investors are concerned that there will be widespread downgrades. If it is not as bad as feared, then this rally could start soon. Investors should stay close to their advisers.”

You can also read more about what’s separating the haves from the have-nots in small caps.

Tags

Disclaimer

*Downside and upside capture – are statistics showing whether a given fund has outperformed–gained more or lost less than–a broad market benchmark during periods of market strength and weakness, and if so, by how much. An upside capture ratio over 100 indicates a fund has generally outperformed the benchmark during periods of positive returns for the benchmark. Meanwhile, a downside capture ratio of less than 100 indicates that a fund has lost less than its benchmark in periods when the benchmark has been in the red (Source – Morningstar).

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.