Wealth Creation Simplified: How starting early can be the key to building long-term wealth

Prioritising your own financial wellbeing earlier in life can feel burdensome, time consuming or intimidating. Considerations such as optimising cashflows, debt reduction strategies, tax management, and establishing investment portfolios can feel overwhelming. However, the wealth creation that can result from addressing these important financial matters can be powerful due to the effect of compounding. Compounding is the process of earning returns on both your initial investments and your accumulated investment gains over time. For anyone with long-term goals, such as wealth accumulation, funding major life milestones or achieving a comfortable retirement, understanding and taking advantage of the benefits of compounding is crucial.

The building blocks for wealth creation

While many factors influence wealth creation, three main drivers stand out:

- Structure: Different ownership structures for investment (e.g., superannuation, trusts, companies, and individual ownership) offer varying characteristics in terms of tax, liquidity, asset protection, and estate planning.

- Contributions: Regular contributions foster healthy savings habits and help to steadily build wealth over time.

- Asset selection: Reducing debt, investing in high-quality assets, and diversifying appropriately can help achieve strong risk-adjusted returns.

Considering these factors holistically is essential for an effective wealth building plan.

Structure: The role of superannuation

Superannuation is one of Australia’s most tax-effective investment vehicles, with earnings taxed at a maximum rate of 15%, compared to personal tax rates of up to 47%. Leveraging this benefit early is essential due to:

- Tightening superannuation regulations governing eligibility for contributions.

- Phasing out of attractive government retirement schemes like defined benefit pensions.

- A greater onus on self-funding retirement, as government benefits only provide a modest standard of living.

Contributions: Small sacrifices, large benefits

Many people tend to put off investing, often due to other priorities and expenses such as a mortgage or school fees. However, adding to your investment portfolio regularly and maintaining a long-term outlook can make a significant difference to your return outcomes thanks to the power of compounding. Compounding is the process where earnings from an investment generate additional earnings (i.e., receiving interest on interest). Over time, this creates a snowball effect where growth accelerates as the investment base expands.

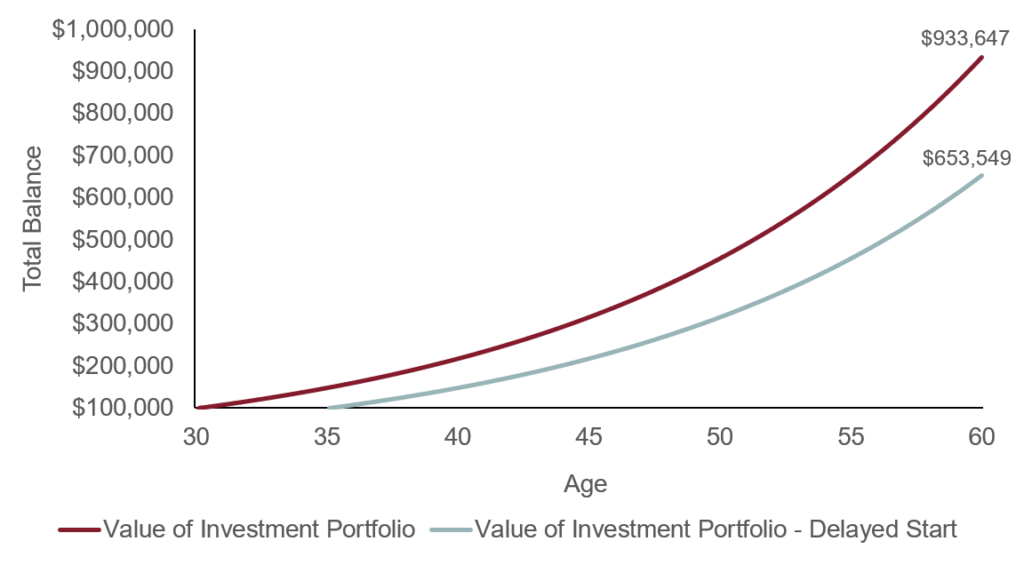

Consider Sophia: with an initial $100,000 investment at a 7% annual return, her balance grows to over $761,000 in 30 years. By adding $100 monthly, her balance reaches $933,000—an extra $172,000 from just $36,000 in contributions. Delaying this strategy by as little as 5 years reduces her balance to $653,000, a $280,000 shortfall.

Sophia’s investment outcomes are graphed below. To help investors visualise their own potential investment trajectory, we have created a compound interest calculator which can be accessed here.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of entry or investment size of holdings.

Asset selection: Returns come out on top

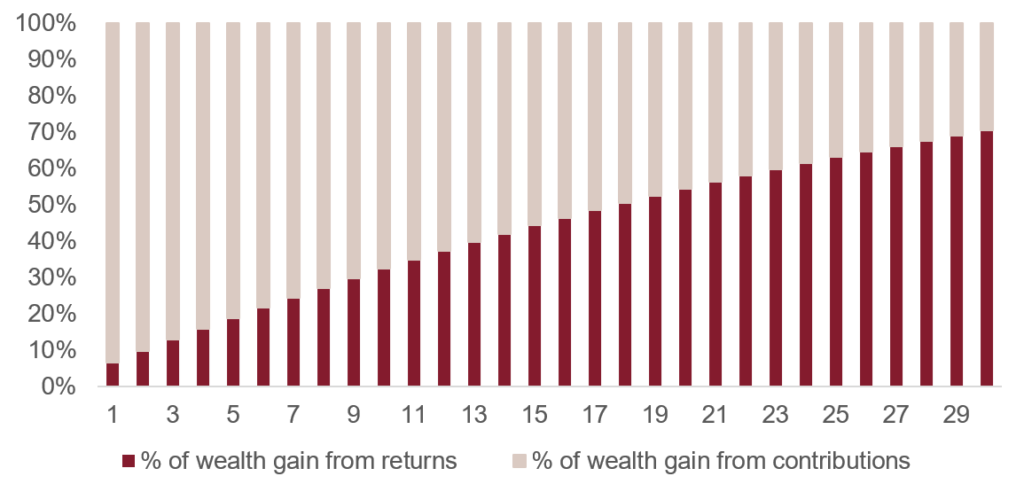

Over any horizon, an individual’s investment balance is the sum of their contributions and returns received. This is a constant, yet the balance between these two factors is dynamic. Consider Ruben, who starts investing with $20,000, earns 7% annually, and contributes $20,000 yearly.

As the chart below demonstrates, over short horizons, contributions are the driving force of portfolio outcomes. In the first year, contributions represent 93% of Ruben’s portfolio’s value, while returns account for just 7%. After 30 years, this relationship inverses such that investment returns become the dominant factor (70%) over Ruben’s contributions (30%).

There are two key takeaways for investors to consider from this relationship:

- Selecting the right assets becomes increasingly vital as returns dominate long-term wealth creation.

- Delaying an investment strategy places a heavier burden on contributions, rather than investment returns, to achieve similar outcomes.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of entry or investment size of holdings.

Overview

An Evans and Partners financial adviser can help tailor a plan to meet your financial goals. For younger individuals, advice can establish a clear path forward to ensure income and savings are invested wisely. For those nearing retirement, each decision carries greater significance on your lifestyle in retirement. The key takeaway: regardless of your age, starting now is always better than waiting until tomorrow.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

The information contains projections and forecasts (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group and its related entities make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. Results are only estimates, the actual amounts may be higher or lower. We cannot predict things that will affect your decision, such as changing interest rates. Seeking professional personal advice is highly recommended before acting on any such assumptions. Past performance is not a reliable indicator of future performance.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.