The Rise of the Sustainable Debt Market

Debt instruments geared toward sustainability outcomes are increasing in prominence within global fixed income markets. These securities are similar in terms of risk and return to conventional fixed income but differ in terms of purpose and use of proceeds. As interest rates have risen, they have begun to offer investors an alternative to generate stable, defensive income – while financing projects with environmental and social benefits.

Alphabet soup

While terminology can be confusing, there are broadly two main types of sustainable debt instruments:

- Use-of-proceed bonds. This is debt that is used to fund projects with specific environmental and/or social benefits. This includes ‘Green’, ‘Social’ and ‘Sustainability’ bonds. Common ‘Green’ financing may include renewable energy development, energy efficiency upgrades and electric vehicle rollouts. Common ‘Social’ financing areas may include access to affordable housing, essential services, or improved food security. ‘Sustainability’ bonds may finance a combination of these activities or target projects with co-benefits.

- Sustainability-linked loans or bonds. These are pay-for-success instruments where the proceeds are not earmarked for specific projects, but the issuer commits to meeting

predefined performance indicators within a specific timeframe. For example, reducing overall greenhouse gas emissions or improving diversity outcomes at a corporate

level. Depending on the structure, the issuer may face a penalty for failing to meet a target, such as an increase in interest payable.

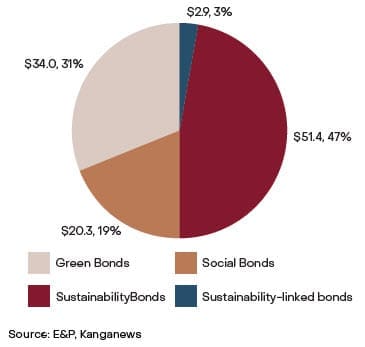

Chart 1: Australian dollar sustainable debt issuances (2014 – 2024 YTD [May]) by type (AUD billion / market share)

The state of play

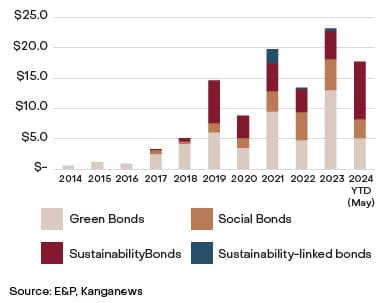

Since its inception, the sustainable debt market has grown exponentially. As at the end of 2023, the market stood at over US$4.9 trillion globally. In only a decade, annual issuance has increased by a factor of more than 100x.

In Australia, this same market has now grown to over $100 billion of issuances, with governments, semi-governments and corporations actively participating. This number is only expected to grow given the financing needs for sustainability objectives. For instance, to achieve Australia’s 2030 targets, renewable energy projects alone are estimated to need $80 billion of capital expenditure. Debt is anticipated to provide 50-70% of this finance.

Chart 2: Australian dollar sustainable debt issuances by year (AUD billion)

Reading more than just the label

The sustainable debt market has both potential and pitfalls. The act of ’greenwashing’, or issuers misrepresenting the benefits of bond proceeds, remains an ongoing challenge. The criteria for issuing bonds remains broad and varies across markets, despite some improvements in frameworks. For example, global meat producer JBS faced significant criticism for its US$3.2 billion 2021 sustainability-linked bond issuance due to questionable emissions claims and calculation methods. Moreover, the sustainable bond market still represents only a fraction of the overall fixed income market. Therefore, there are risks related to liquidity and concentration in certain issuers, sectors or regions. To address

this, investors should adopt a sophisticated approach via specialist managers or those with skills to actively manage portfolio risk.

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.