The Next Phase of AI

Our thoughts on DeepSeek and underlying trends for Data Centers

A key investment theme in recent years has been the wave of demand for data centers driven by cloud adoption and the coming AI wave. The launch of the DeepSeek-R1 large language model in January 2025 caused dramatic reactions across the technology sector and equity markets. The perceived threat to AI industry leader Nvidia generated the largest ever daily drop in value (~$600bn) for a single company on the US stock market.

In the wake of this negative market reaction, E&P’s Technology sector analyst Paul Mason has reviewed these new developments in the AI space and concluded that the market’s interpretation of the meaning of DeepSeek-R1 was wrong, and he believes that demand for compute should accelerate harder as a result.

We think that the overall infrastructure requirements underpinning DeepSeek-R1 are more equivalent to existing efforts like OpenAI than initial reports concluded.

Our most recent analysis of industry data suggests that demand signals from the semiconductor sector look extremely strong still, with sequential growth rates expected for AI related services, and no meaningful let up for NVIDIA in particular.

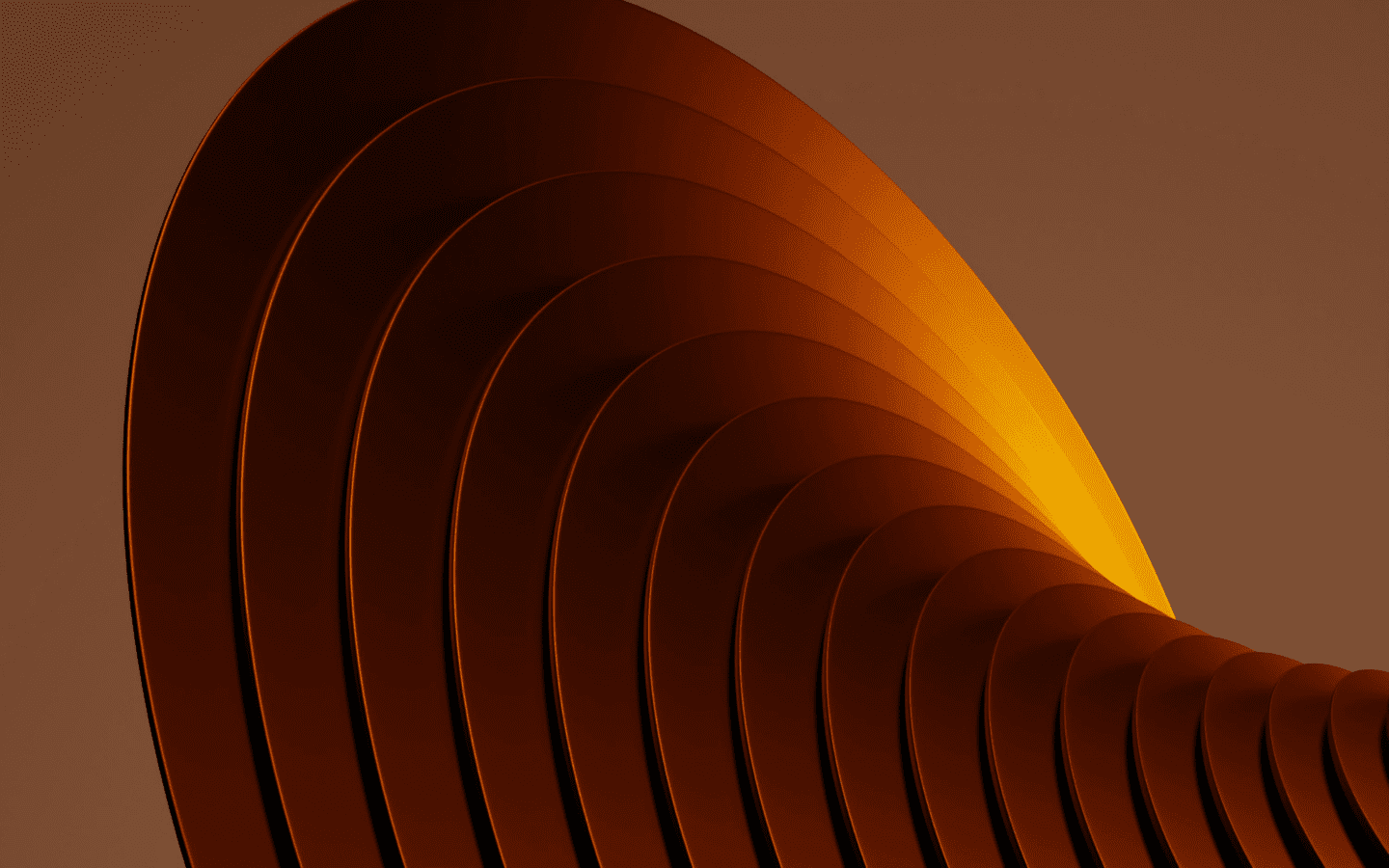

Whilst there have been reports of hyperscalers such as Microsoft potentially cancelling data center leases and slowing international growth, the data tells us that all the hyperscalers have been spending record capex on data centers and compute capacity, and guiding to further growth in 2025. All hyperscalers reported infrastructure capacity constraints as holding back further AI growth, and an inability to meet current demand for AI services. Commentary from the hyperscalers has indicated substantial end-user adoption and utilisation as well, meaning that the revenue streams supporting the major capex expansions look fundamentally robust and sustainable. Following record capex spending in 2024, we expect hyperscaler capex to rise 40% in 2025.

ASX Players in Data Centres

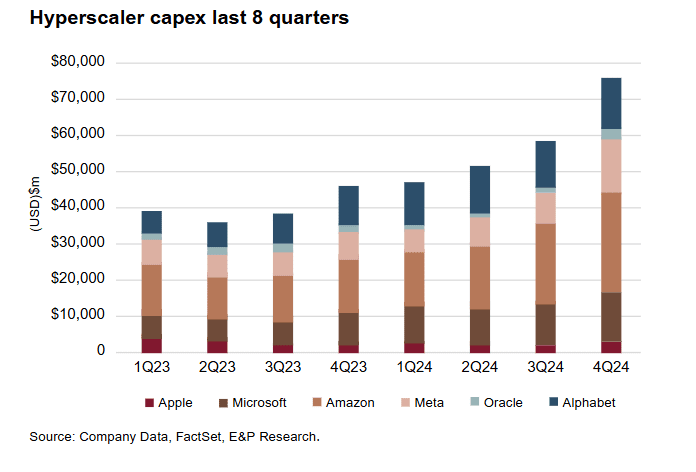

The Australian equity market now has a variety of exposures to the data center theme. NEXTDC has been listed since 2010 and has now grown to a mkt cap of >$8bn with over 1.5GW of power planned, but only 189MW of built capacity and 70MW of capacity under construction so far. Goodman Group, traditionally an owner, manager and developer of industrial properties, recently completed a $4bn equity raising to fund its data center development strategy.

Data Centre Expansion

They have announced 5 GW of development opportunities with 2.6GW secured. 0.5 GW of new data centre development projects are anticipated to be underway by June 2026, with an estimated end value of >$10bn. GMG’s expected share of development costs over the next few years is ~$2.7bn. DigiCo Infrastructure REIT, a roll-up of data center assets in Australia and the US managed by HMC Capital, listed in December 2024. Its flagship asset is Global Switch Sydney, which they intend to expand from 42MW theoretical capacity today up to 88MW.

Volatility and rapid pace of change will continue to be features of the technology sector landscape as adoption of the cloud and AI accelerates. Nonetheless, we see attractive opportunities emerging for long term investors, particularly in the data center sector which provides the essential infrastructure underpinning this growth.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.