Taking Advantage of Tax Cuts

From 1 July 2024, Australia’s stage 3 tax cuts have taken effect for all 13.6 million Australian taxpayers. Designed as a component of the Australian Government’s cost of living relief package, the tax cuts present a unique opportunity for individuals to bolster their retirement savings without having to adjust their budgets.

What are the stage 3 tax cuts?

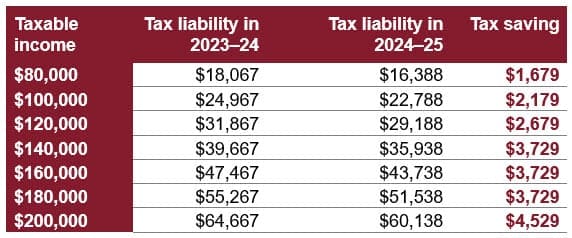

The stage 3 tax cuts were first announced in the 2018–19 Budget and, after a redesign in 2024, have been legislated to take effect from 1 July 2024. The tax cuts will see a reduction in tax rates as well as an expansion of select tax brackets to ensure more income is taxed at lower rates. The table below shows the impact of these tax cuts on a range of incomes:

Making additional concessional contributions

Contributing personal tax savings into superannuation presents an opportunity for long-term wealth accumulation. Concessional contributions to superannuation benefit from a lower tax rate of 15%, making it potentially advantageous for couples or individuals aiming to boost retirement savings.

Concessional contributions are before-tax contributions to super for which an individual or their employer claims a tax deduction. The two most common avenues to make these contributions are via:

- Salary sacrifice: Utilising salary sacrifice arrangements allows an employer to reduce your taxable (take home) pay and instead use these funds to make additional contributions directly to your chosen superannuation fund.

- Personal contributions: You can also make concessional contributions directly to your superannuation fund from funds held outside of super (i.e., your bank account). If doing so, you will also need to submit a notice to claim a deduction form to your superannuation provider and then claim this as a tax deduction in your individual tax return.

The concessional contribution limit in the current financial year is $30,000 (discussed here). It is important to note that your employer superannuation guarantee payments also count towards this annual limit.

Compounding returns: the key to growth

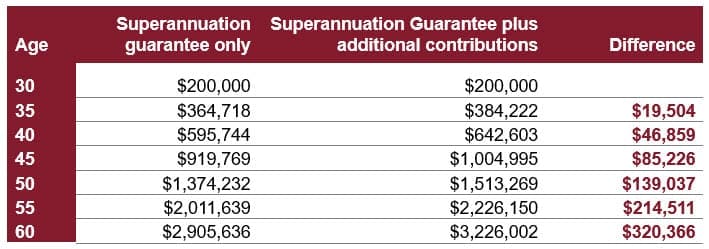

To illustrate how these tax savings can grow if contributed to superannuation, take the example of Natalia. Natalia is a 30-year-old engineer who is earning $140,000 and has a superannuation balance of $200,000. Each year, Natalia’s employer contributes 11.5% of her salary (or $16,100) to her superannuation fund (note, the minimum employer contribution has increased as of 1 July 2024).

In the 30 years to retirement, if Natalia’s income remains constant and her fund delivers a return of 7% per annum*, her balance will grow meaningfully. However, if she redirects her tax savings of $3,729 per annum from the stage 3 tax cuts as pre-tax contributions, not only will she benefit from a tax deduction immediately but also an extra $320,366 to spend in retirement. Even small additions to superannuation can make a significant difference if compounded over the long-term.

Please note, the above table is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, tax paid, and your relevant personal circumstances.

*An investment return of 7% is based on an Evans and Partners Model Portfolio 7 which targets a return of CPI +4.5%.

Maximising your superannuation balance

Personal contributions and salary sacrifice arrangements are not the only avenues to boost your retirement savings and benefit from positive compounding effects. Other common avenues include:

- Catch-up concessional contributions: Individuals like Natalia with a superannuation balance below $500,000, may also be able to utilise unused concessional contributions from the previous 5 years. This means potentially making a concessional contribution above the annual $30,000 limit and benefiting from a larger tax deduction.

- Non-concessional contributions: Non-concessional contributions refer to after-tax contributions for which an individual or employer has not claimed a tax deduction. Despite not offering a tax deduction, annual limits are higher ($120,000) which allows for a more significant increase in your retirement savings trajectory (discussed here).

Generally, it is most tax effective to prioritise pre-tax contributions. If the concessional contribution cap is fully maximised or you’re ineligible to make concessional contributions, then the next best thing is usually non-concessional contributions.

Overview

The contribution rules are complex and there is much to consider when deciding how best to use your tax savings this year. It is well known that starting early is key to ensuring funds can benefit from compounding over a longer period so get personalised advice before making changes to your strategy, particularly while it is still early in the financial year.

Tags

Important information

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.