Strategies to Manage your Mortgage at Every Stage of Life

Home ownership is an important goal for many Australians. Whether you are saving for your first home, repaying your loan, or nearing the end of your mortgage, there are various strategies to help you save—be it additional funds for your deposit, reduced interest costs, or a larger investment portfolio for the future. Ensuring your broader financial strategy aligns seamlessly with your property aspirations is crucial to building a strong financial foundation.

Stage 1: Using super for your deposit

For many Australians, rising property prices and cost-of-living pressures have made saving for a deposit increasingly challenging. According to the Finder Wealth Building Report 2024, budgeting carefully and saving additional income is the most common approach used by Australians seeking to increase their net wealth. While this is an important step in building a deposit, leaving these funds in an ordinary transaction account can result in unnecessary taxes and missed earnings.

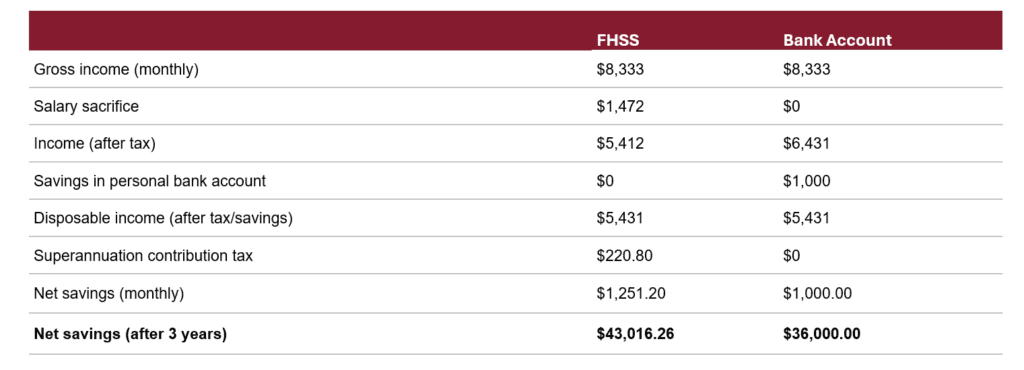

To address this, the Australian Government introduced the First Home Super Saver (FHSS) Scheme, which allows individuals to leverage the tax advantages of superannuation while saving for a home. Consider Eliza, an engineer earning $100,000 (plus superannuation), who uses this scheme to build her deposit. Eliza’s goal is to save $1,000 each month.

If Eliza saves this amount in a bank account, she will accumulate $36,000 over three years. However, by utilising the FHSS and salary sacrificing $1,472 monthly, she can maintain the same monthly disposable income ($5,431) while saving an additional $7,000 for her first home purchase. Further details on the scheme can be found here.

Please note, the above table is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, and your relevant personal circumstances. Superannuation withdrawals are only permitted if a condition of release is met.

Stage 2: Reducing your interest payments

Once you have purchased a home, your mortgage will likely become your largest financial obligation, often spanning decades. However, with the right strategies, you can take control of your repayments, reduce the total interest paid, and potentially pay off your loan much faster than originally planned. According to the Mozo Home Loan Report 2024, as many as 75% of mortgage holders are concerned about their home loan repayments, yet nearly half (46%) are not utilising an offset account.

An offset account functions like a regular bank account, allowing for withdrawals and transactions. The key benefit is that the funds held in the account directly reduce the loan balance on which interest is calculated. For example, an individual with a $500,000 loan and $50,000 in an offset account is only charged interest on $450,000. At a 6% interest rate, this results in a monthly saving of $250.

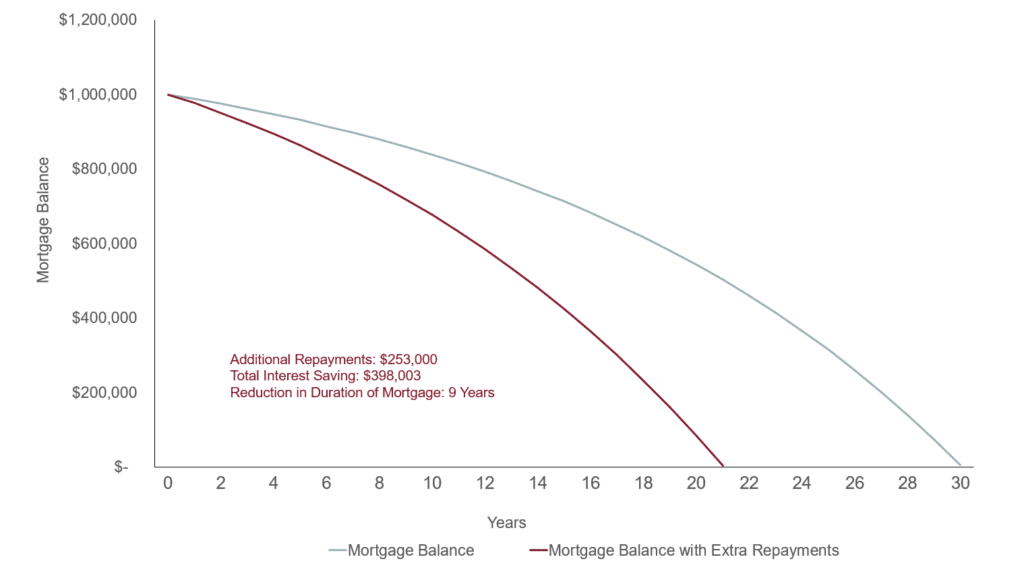

For many mortgage holders, a large sum of capital to maintain in an offset account is not always available. Consider Anthony as an example: Having just purchased a home, he used his surplus cash as a deposit. Anthony instead focuses on saving additional funds in his offset account. With a mortgage of $1,000,000 at a 6% interest rate and monthly repayments of $5,996, Anthony saves an extra $1,000 each month in his offset account. This strategy allows him to save close to $400,000 in bank interest over the life of his loan and repay his mortgage nine years ahead of schedule.

Mortgage holders should consider:

- Refinancing regularly to ensure you are receiving a fair interest rate

- Taking advantage of ‘cash back’ offers and incentives offered by lenders

- Increasing the frequency or amount of your mortgage repayments to repay your loan faster

- Finding a lender that provides access to features such as an offset account

A mortgage broker can assist by comparing lenders on your behalf to make the process of optimising your loan arrangements as straightforward as possible.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on loan conditions, interest rate movements, fees, and your relevant personal circumstances.

Stage 3: Investing for your future

While repaying your mortgage is important, it should dovetail with your broader financial strategy. There are various concessions available to individuals who can contribute additional funds to superannuation. Beyond the associated tax benefits, investing outside your home is important due to:

- An unrealised asset: While your home is likely to remain a significant asset in retirement, it typically does not generate regular income or allow access to its value.

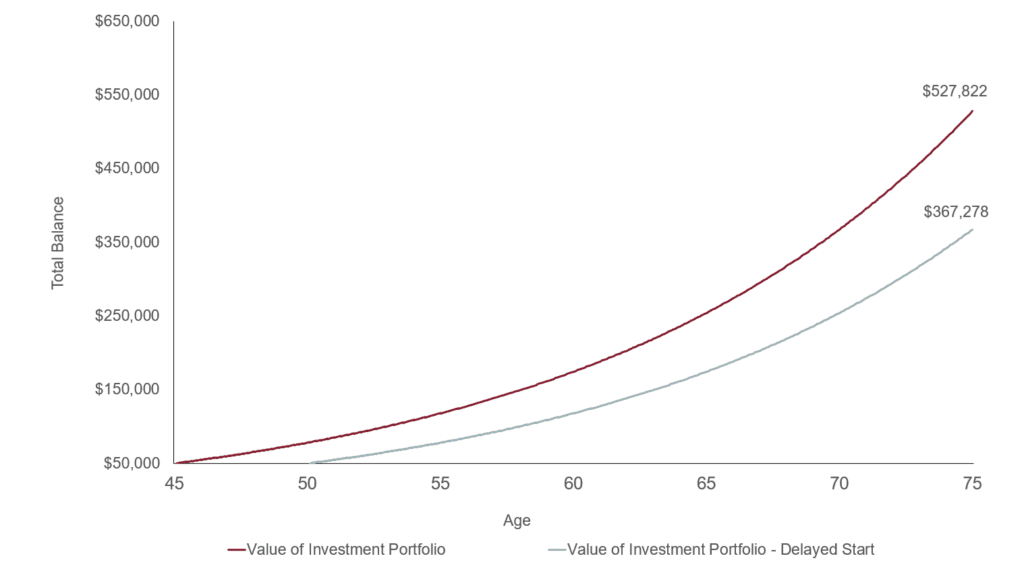

- The benefits of starting early: Early investment has a significant impact due to the power of compounding. For example, a $50,000 portfolio growing at 7% annually would reach $405,825 over 30 years. However, adding monthly contributions of just $100 could grow this to $527,000. Delaying this strategy by just five years reduces the balance to $367,000—a $160,000 shortfall.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of entry or investment size of holdings.

Overview

Finding the optimal investment mix across areas such as your mortgage and superannuation can be challenging. Small changes in mortgage costs, interest rates, and investment returns can have a significant impact due to the effects of compounding. An Evans and Partners financial adviser can help identify the key considerations and develop an investment strategy that not only addresses your current needs but also secures your lifestyle in retirement. Your adviser can also facilitate a referral to a mortgage broker to assist with your home lending requirements.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.