Staying the Course

Global equity markets are at an interesting inflection point. After consecutive years of strong returns, investors have been confronted with their first major bout of volatility thanks to President Donald Trump’s aggressive trade policies and antagonistic posturing towards global leaders.

Markets are understandably anxious given the high levels of uncertainty and ever-changing nature of President Trump’s policies. This makes the task of quantifying the potential economic and market implications near impossible.

Riding the Market’s Ups and Downs

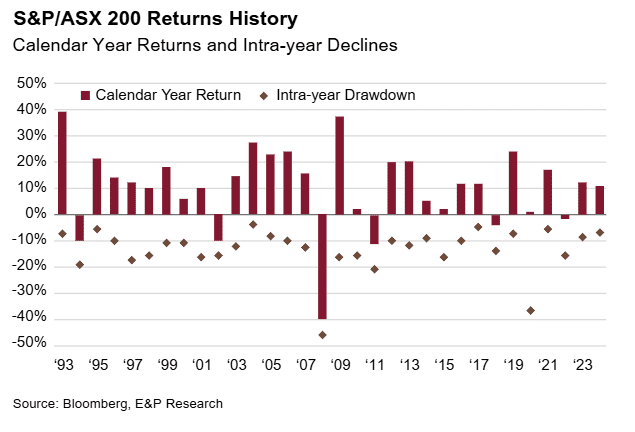

It is worth remembering though that “volatility is the price of admission”. Market fluctuations and uncertainty are inherent to investing and, in fact, necessary to achieving long-term superior returns. As shown opposite, in any given year, the Australian equity market will almost inevitably experience a peak-to-trough drawdown of at least 10% and still manage to post positive absolute returns. Obviously, there is the risk that losses can extend to be much larger, however this will typically only occur when accompanied by a deep and pronounced recession (see 2008 and 2020).

A recession in the US now appears increasingly likely, though the depth and duration remain uncertain. Amid ongoing economic instability, businesses are expected to delay investments and capex (capital expenditure) outlays until there is greater clarity on tariffs and export restrictions. Similarly, households may scale back consumption and prioritise savings if job security concerns grow. Domestically, sub-par growth remains heavily reliant on government investment and net migration, while consumption has been subdued due to cost-of-living pressures and restrictive monetary policy – both of which now show signs of easing. Given the heightened U.S. recession risks in recent months and elevated equity market valuations, a cautious approach remains prudent.

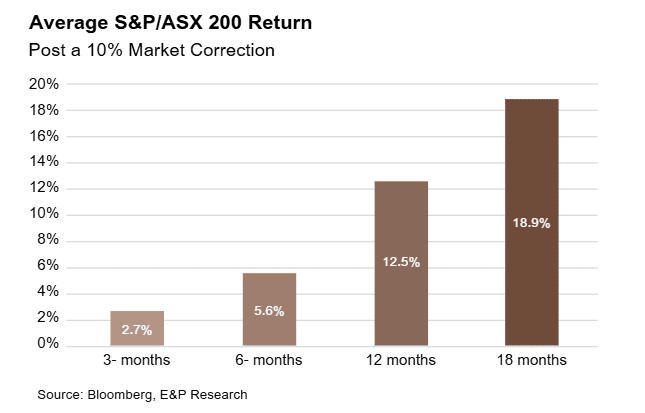

That’s not to say we should do nothing. History also shows a 10% correction in equities has traditionally been a good trigger point for investors with markets (on average) higher over subsequent 6, 12 and 18-month time horizons.

This could hold true again should US policy uncertainty recede, particularly given the resilience of the labour market, health of the corporate sector and supportive fiscal settings.

Instead, we believe a more pragmatic and nuanced approach to equity investing is required against this backdrop, opting to weight portfolios to those markets or regions with reasonable margin-of-safety and/or earnings tailwinds, instead of those seemingly priced for perfection. Europe and Emerging Markets are two such regions that have been aided by the ongoing global rotation and should continue to benefit from structural policy reform (fiscal stimulus), light investor positioning and reasonable valuations. Likewise, US mid and small-cap companies should be well positioned to benefit from protectionist US policies, sweeping deregulation and eventual tax cuts.

Looking Ahead

Locally, our advice is much the same. We continue to encourage clients to be increasingly selective in their exposures, highlighting that market-weight indexes remain overvalued despite offering little earnings and dividend growth over the next 2 to 3-years. Instead, we point to stock specific opportunities with strong fundamentals while also highlighting market segments, such as mid-caps, which are offering superior earnings growth potential and look well positioned to benefit from an improving domestic economy on the back of interest rate cuts, income tax cuts and strong government spending.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.