Silver Linings in the New World

It might not feel like it, but the investing environment is better now than two years ago. Specifically, it’s a better entry point for long-term investors — for two reasons:

- expected returns are higher across almost all asset classes

- better returns are on offer in some less risky asset classes (cash, credit and bonds)

In the current market, most investors can generate more return by taking on less risk.

Based on our expectations for annual average returns for each asset class over the next decade, we expect an investor entering the market today with a ‘balanced’ portfolio to average returns of around 7.2% per annum. This estimate is about 1.5% higher than an investor entering the market two years ago.

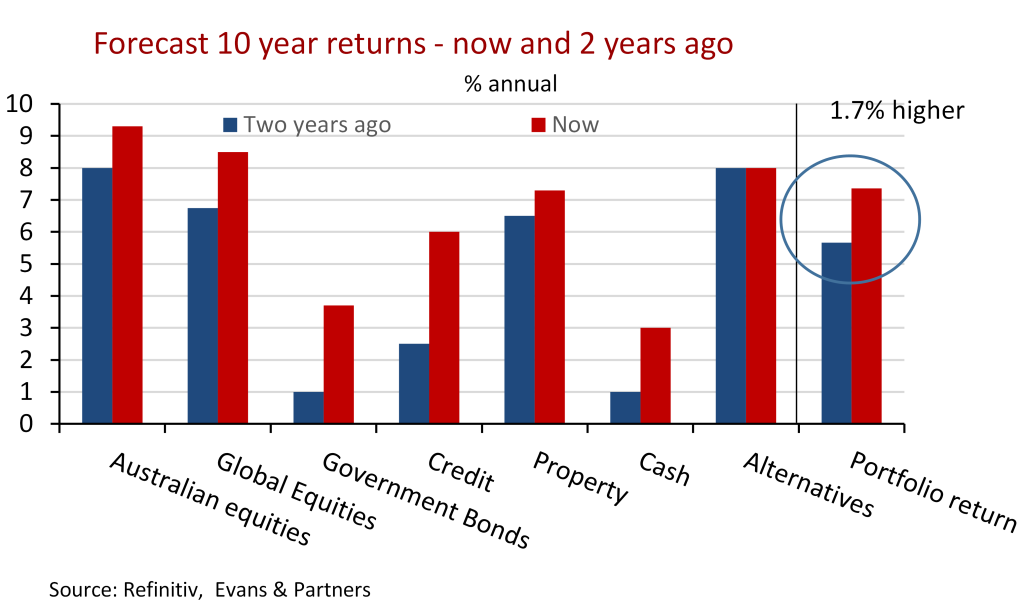

The chart below summarises these findings.

The asset classes linked to interest rates show the most significant change.

Expected returns on cash have jumped from 1% to 3%, government bonds from 1% to nearly 4% and credit from 2.5% to 6%.

Credit offers a range of opportunities. US investment grade is currently around a 5% return but is likely to rise further as the Fed continues to raise rates. High-yield and emerging market debt are also promising, varying between 6% to 10%. As interest rate securities typically represent around 30% of a balanced portfolio, these changes most significantly boost the projected returns.

Equity markets currently have higher returns because of the lower starting point for valuations. Critically, the price you pay determines the future return for equities. And valuations are much lower than at the market’s peak in 2021.

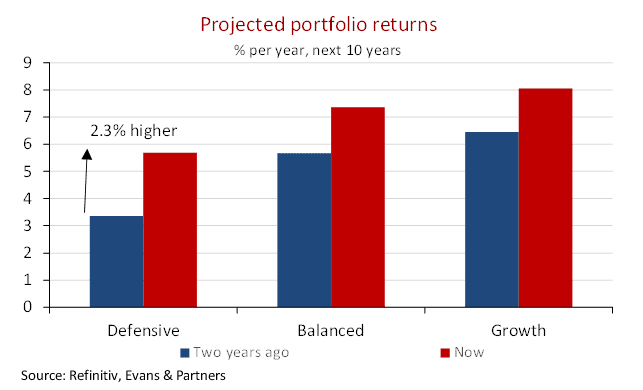

An important consequence of a lower starting valuation is a change in the risk-reward ratio. Ultra-low interest rates forced defensive investors to take on more risk because the return on many ‘safe’ assets fell below the inflation rate.

Bonds and cash holders were likely to see the real value of portfolios decline. But this is no longer the case — investors can make far better returns without too much risk. The expected return on defensive portfolios has increased the most of all the risk profiles — by around 2.3% to 5.7%. And at that level, it represents a reasonable real return for investments. This compares with the return on ‘growth’ portfolios that have risen from 1.6% to 8%.

Investors often ask us whether the higher inflation rate will make it harder to achieve benchmarks expressed relative to the inflation rate. My view is the central banks will eventually get inflation under control — and the long-term average inflation rate will only be slightly higher than before — around 2.5% to 3% in the future compared with 2% to 2.5% in the past.

Since our expected returns have increased more (1.6% to 2.3%, depending on the risk profile), we’d argue that existing CPI plus benchmarks should be easier, not harder, to achieve.

Current recommendations

There are plenty of opportunities for investors now, particularly in interest rate securities and infrastructure:

- Interest rate securities: we prefer floating rate, investment grade and private credit, with a range of options with yields from 6% to 8%.

- Unlisted infrastructure: there’s an opportunity, given the potential to return 8% to 10% per annum over the next few years.

In equities, we’re more selective (for now):

- We’d hold off from adding broad market exposure in equities. Our strongest recommendations are in Chinese H shares, Commodities and Small Cap companies in the US and Australia.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.