Seizing Opportunities in Interest Rate Securities

Recent surges in bond yields make interest rate securities, particularly investment grade credit and longer-term fixed-rate government debt, attractive compared to equities. We explore options in investment grade credit, fixed-rate government debt, term deposits, and private credit, and look at the areas that require caution.

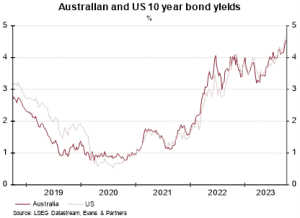

The jump in official and long-term interest rates has improved prospects for interest rate securities. Recent attention has been on government bond yields that have surged higher.

This has changed the landscape for this asset class and investors should be looking to increase their exposure. In many instances, interest rates securities now offer a better combination of risk and return than equities. In the US market, yields on investment grade credit now exceed the earnings yield on equities for the first time in 15 years.

The sharp jump in bond yields has a range of causes. Resilient economies and rising oil prices suggest that inflation may not be completely extinguished. There are also concerns that some major holders of US government debt will now be ongoing sellers (the Bank of Japan, Chinese reserves and the Federal Reserve through quantitative tightening), and future US bond issuance will be substantial to finance ballooning budget deficits.

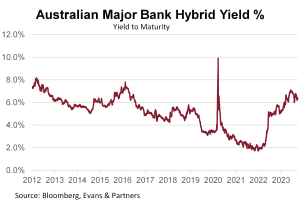

Higher rates have flowed through to parts of the market in different ways. Floating-rate securities with shorter maturities have seen the biggest jumps in yields. This is behind our preference for investment grade credit. With the resetting of interest rates these are now offering returns of 7-9% – around double the rate of a couple of years ago.

The recent jump in longer-term fixed-rate government debt now also makes this asset class attractive and we have begun to build positions here.

Term deposit rates are starting to rise and there are now some offers around 5%. Investors should be careful about locking away money for too long, however, because ongoing volatility in markets could create opportunities for those with cash on hand. Returns for hybrids have also risen in line with the increase in short term interest rates such that current yields-tomaturity are around 6%. Further increases in rates could push them up further.

Investors should also consider some exposure to private credit. Some corporate borrowers are struggling to access funds because banks are less willing to lend and listed debt markets remain effectively shut to new issuance. They are increasingly turning to private credit providers who are able to charge higher rates with more favourable terms. This is an opportunity for investors, but investors should also be wary of the potential for rising defaults and ensure they invest with experienced managers.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.