Recession Refresher

A US recession is the most likely scenario for 2023. Financial strains are rising, yet the Federal Reserve remains more concerned about the medium-term implications of high inflation than the potential damage to the financial system.

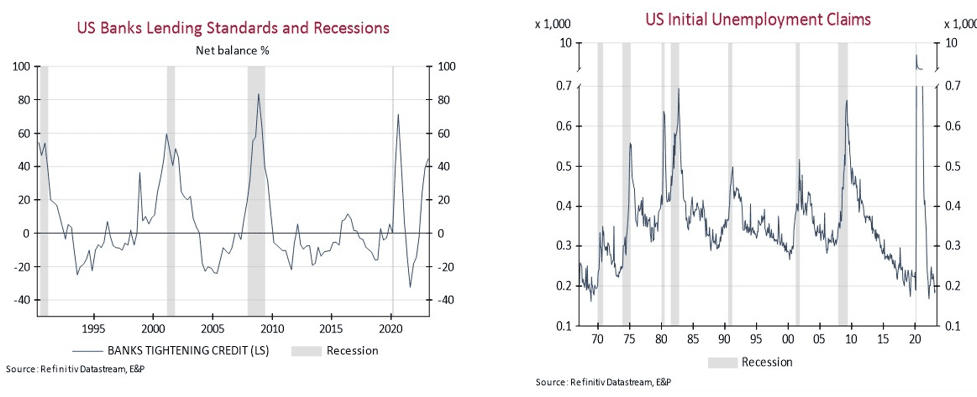

We don’t expect this to develop into a financial crisis; however, there will be further pressure within the financial system, and tightening lending standards will contribute to slowing economic activity. History shows that tightening lending standards have significantly influenced all previous US recessions.

Several leading indicators, including those related to housing and manufacturing, are pointing to a recession at some point this year. The one area yet to be consistent with a recession is the labour market, which remains remarkably robust despite emerging weaknesses and layoffs across several sectors. Unfortunately, this is a crucial factor for the Fed as this is the source of inflation pressure through wages. We still believe the Fed has to keep rates high until the labour market cracks, which will define the start of the recession

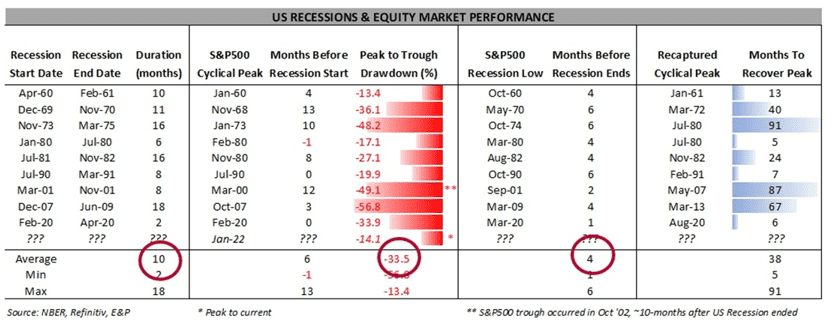

As a reminder of what a recession might look like and how equity markets typically react, the table below reviews US recessions over the past 50 years. While every recession is different, recessions have typically lasted ten months over this period, and equity markets trough around the midpoint after an average fall of 35%. Earnings also typically fall around 15%.

This time we assume that the recession will not be as bad as the COVID shock or the GFC and, therefore, close to the average suggested by the above analysis. Assuming that the recession starts around the middle of this year, this points to an equity market trough near the end of the year. However, the valuation starting point is high, and there is a range of pressures on US earnings, including high margins, extreme cost pressure, and the rising $US. This suggests a risk that the market trough may occur significantly lower than where it is currently trading.

Australian implications

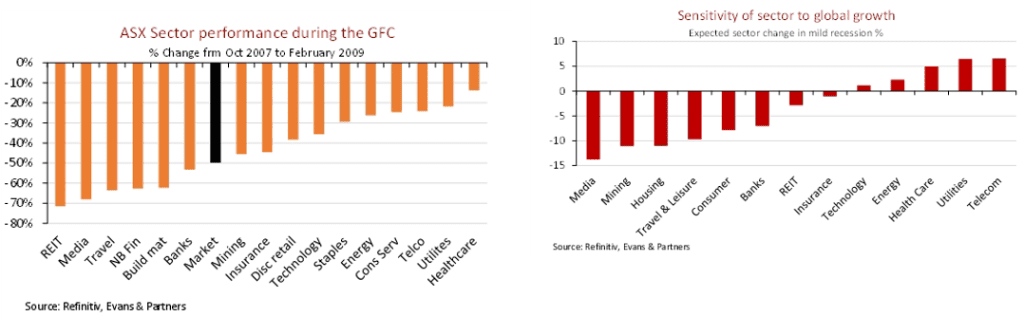

We believe there are fewer risks in the Australian market with better valuations, less risk to earnings, and less inflationary pressure for the RBA to negotiate. However, there will still be a range of implications; the risks are in the same direction, and the Australian market is always captive to Wall Street developments.

Investors can mitigate the damage by ensuring they are appropriately positioned at the sector level and not overly exposed to sectors most vulnerable to deteriorating economic conditions.

We have found the sectors most vulnerable to weakening growth are:

- Media has always been the most susceptible, being a highly discretionary item

- Building materials, given the exposure to deteriorating housing

- Banks and non-bank financials, based on their leverage ratios.

The sectors that typically outperform are the predictable defensive sectors of telco, utilities, and healthcare.

As always, stay close to your adviser.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.