Opportunities From Higher Rates

With a challenging outlook for government bonds that have typically served as the foundation of the defensive allocation within portfolios, it’s increasingly important for investors to consider a range of non-traditional fixed income assets to hedge against inflation.

It is becoming increasingly evident that we have entered a structurally higher and more volatile interest rate environment. This is causing us to question the role that traditional diversifiers, such as government bonds, play in a portfolio going forward, while also encouraging us to explore non-traditional assets as differentiated sources of return and inflation hedges.

We identify three key forces contributing to a structurally higher inflation backdrop:

- Growing geopolitical volatility will reverse previous efficiencies generated from globalisation via protectionist policies such as the reshoring of supply chains and more expansive tariffs to increase the competitiveness of domestic industries.

- Ageing workforces and declining participation rates will add pressure to already tight labour markets, potentially driving up wages while also placing more strain on government fiscal positions given their need to spend on pensions and healthcare.

- The transition to low-carbon technologies and renewable energy sources will involve significant upfront investments in new infrastructure while also diverting capital away from traditional energy sources which could contribute to higher energy costs and input prices.

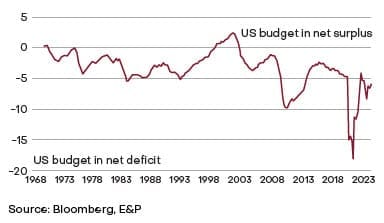

US Budget Balance (As % of Gross Domestic Product)

Challenging backdrop for government bonds

A higher and more volatile inflation environment is generally seen as a more challenging backdrop for government bonds because it creates shorter and sharper interest rate cycles, while also increasing the opportunity cost of holding risk-free assets. This is a conundrum for asset allocators because government bonds have traditionally been viewed as a defensive staple; hedging against economic and geopolitical risks while providing a stable source of income.

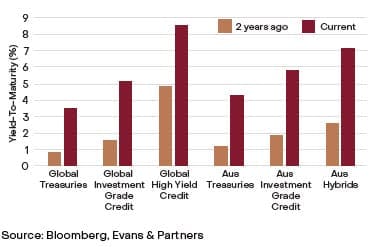

One-way investors can counter this is by increasing their exposure to floating rate securities, where forward-looking returns move in tandem with interest rate or inflation expectations. Domestic floating rate credit exposures remain one of our highest conviction investment ideas in this space thanks to reasonable valuations, attractive all-in yields and strong underlying fundamentals (credit quality).

Fixed Income Yields

Yield-to-maturity, current vs. 2-years ago

Private credit exposures can also play a valuable role here, albeit investors should not underestimate the risks associated with the asset class. Huge sums of capital have been raised and deployed in recent years, creating more competition across lenders and subsequently resulting in tighter spreads and lower underwriting standards. Despite these concerns, we retain a positive outlook on the sector given our confidence in the resilience of the global economy which should mean that any ensuing credit cycle is relatively shallow with lenders adequately compensated via double digit yields.

Turning to hard assets

Another solution for investors is to increase exposure to ‘hard assets’ such as infrastructure, real estate and commodities where cash flows or asset values are, in one-way or another, positively correlated with inflation. We expect these assets to play a pivotal role in investment portfolios going forward as sources of both income and capital growth. The opportunity set in the infrastructure asset class looks particularly plentiful given the capital and investment requirements associated with the energy transition as well as the commitment from (and social pressure on) governments around the world to meet ambitious emission targets.

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.