Operation Rotation

After a golden period for equity markets, we have entered a more uncertain and challenging environment.

The trade war effect on growth and inflation, the policy response from other governments and changing views on the evolution of artificial intelligence will determine macro and market outcomes over the rest of this year.

We believe we are now entering a technical US recession, while our outlook for Australia is more positive. Policy shocks in the US including tariffs, government austerity and immigration cuts create significant uncertainty and have placed trade, investment, hiring and spending decisions on hold. The risks to inflation will also limit the ability of the US Federal Reserve to respond to any deterioration in conditions.

It is important to note that the US economy has no structural problems and the damage from tariff chaos should be reversible if Trump changes his approach quickly.

There is also an offset at the global level from pre-emptive and large policy responses in other major economies particularly Germany and China. We expect that policy responses in Europe, China and many other countries will end up swamping the downside from tariffs for those countries. The new German government has exceeded expectations with plans for huge fiscal stimulus and higher defence spending. Trump is forcing Europe to wake up and is sparking a European revival. China has also recently stepped-up support in the form of greater fiscal support, consumer subsidies and policies to support tech innovation. Similar measures, along with currency depreciation were enacted during the first phase of the trade war in 2018 and were effective in mitigating the pressure on the export sector.

The Australian economy has been held back by the pressures from higher cost of living and interest rates for several years.

However, conditions are starting to improve due to an interest rate cut, income tax cuts and strong government spending. Companies have reported that spending has been higher since late 2024. This better operating environment should be positive for corporate earnings through the remainder of 2025.

The best way to deal with market volatility is to have a diversified portfolio that contains broad exposure to a range of countries and asset classes. Now that markets have started correcting, investors should start looking for opportunities being created by the turmoil. Selloffs tend to be indiscriminate and this creates the opportunity to buy good assets at cheaper prices and, in this way, to “upgrade portfolios”.

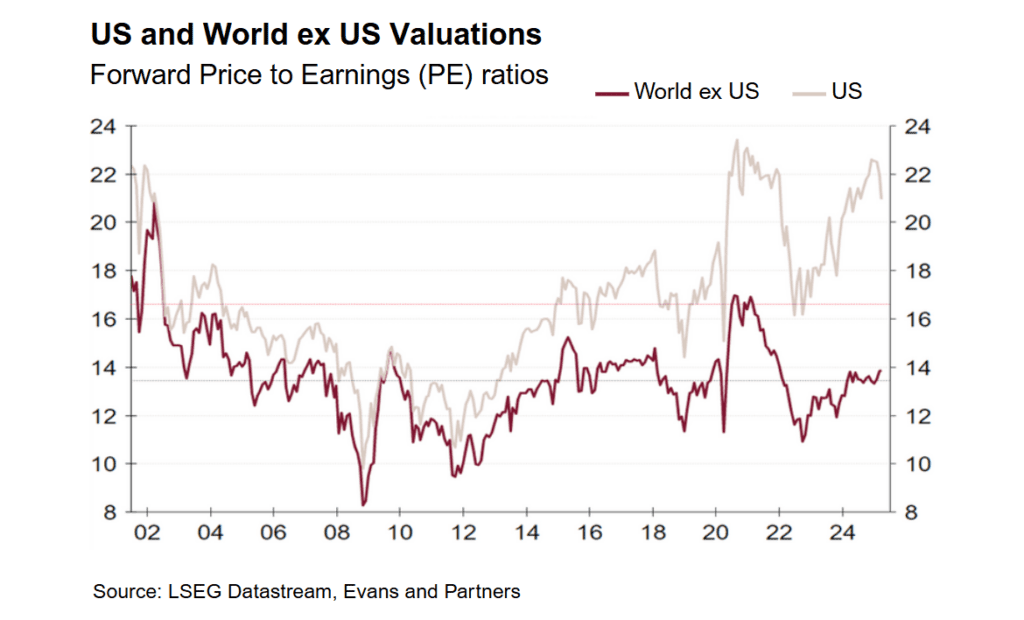

A major theme already evident, and which we expect to continue, is rotation in equity markets. Investors have begun to switch to other regions (Europe and Asia), from growth to value sectors and from large caps to a broader set of companies. This rotation is supported by the starting point for valuations, aggressive investor positioning and the different outlook for policy in the different regions.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.