Missed Super Contributions? How to Catch Up and Build Wealth

The benefits of starting early in superannuation are clear, as the power of compounding, combined with its tax-efficient structure, makes early investment compelling. However, many individuals delay contributions due to other financial priorities, such as education, cost-of-living pressures, property purchases, and raising children. The ability to use carry-forward contributions provides an opportunity to ‘catch up’ by making larger one-off deposits into superannuation, which can help grow your balance and provide tax savings.

What are carry forward contributions?

Concessional contributions typically include those made by an employer, salary sacrifice arrangements, or personal transfers where a tax deduction is claimed. The effect is to reduce your taxable income and thus, provide tax savings. Due to their attractiveness, limits are in place to govern the maximum amount that can be contributed to superannuation in this way. For the current financial year (ending 30 June 2025), this limit is $30,000.

A carry-forward contribution allows individuals to ‘catch up’ by making contributions beyond the current year’s limit, using unused portions of the cap from the previous five years. To be eligible to carry forward unused contributions, an individual must have:

- A total super balance of less than $500,000 at 30 June of the previous financial year.

- Unused concessional contributions cap amounts from up to 5 previous years.

How can carry forward contributions be used?

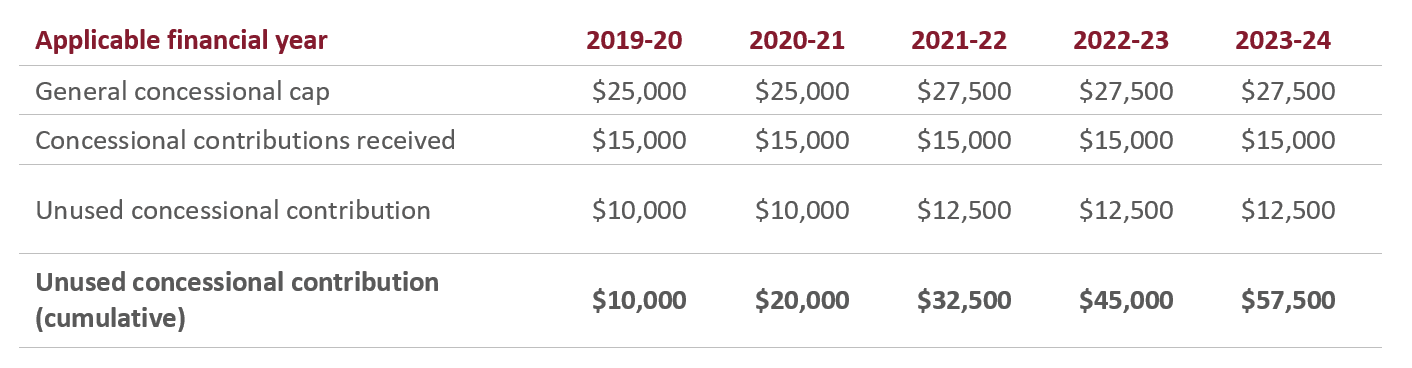

Individuals who have not maximised their contributions over the past five years can take advantage of this strategy. Importantly, the provision operates on a ‘use it or lose it’ basis, with unused contribution caps progressively forfeited. As a result, the current financial year is the final opportunity to utilise unused amounts from 2019–20.

For example, Riley has received super contributions of $15,000 from her employer in each of the past five years. After recently selling an apartment, she now wishes to contribute additional funds to her superannuation. Without using her carry-forward limits, she would be able to make a concessional contribution of $30,000. However, by leveraging this strategy, she can contribute an additional $57,500.

Source: E&P

Please note, the above table is for illustrative purposes only and does not constitute advice.

Benefits of carry forward contributions

An individual like Riley benefits in two ways from making a carry-forward contribution. In the short term, she gains personal tax savings, while in the long term, her superannuation balance grows significantly.

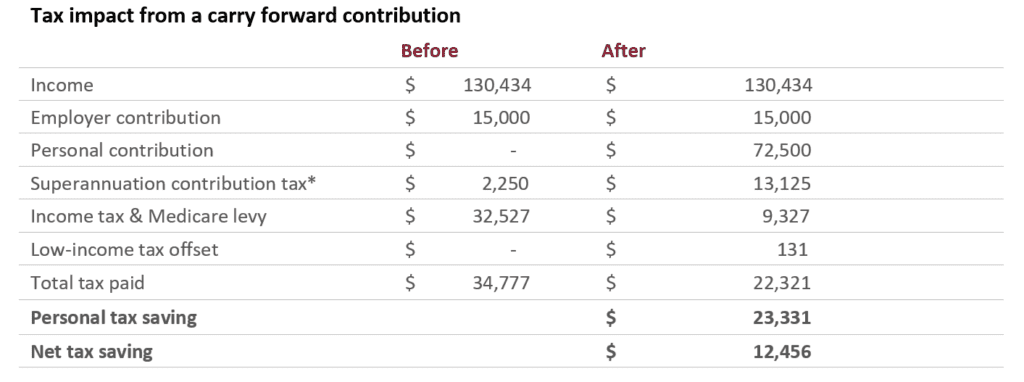

From a tax perspective, the table below outlines Riley’s financial position. She currently earns $145,434 per annum (including super) and was able to sell her apartment without incurring capital gains tax, thanks to the ‘six-year rule.’ This rule allows Riley to continue treating the rented apartment as her principal place of residence for tax purposes for up to six years after moving out. As a result, Riley contributes $72,500 to her super fund. This figure reflects her maximum allowable contribution based on the current year’s concessional cap of $30,000, her carry-forward amount of $57,500, less the $15,000 she will receive from her employer contributions.

When Riley submits her tax return for the 2024–25 financial year, she will receive an estimated tax saving of approximately $23,000.

Source: E&P

* Please note, the above table is for illustrative purposes only and does not constitute advice. Deposits made to an accumulation account attract a contribution tax of 15% that is paid from the super fund.

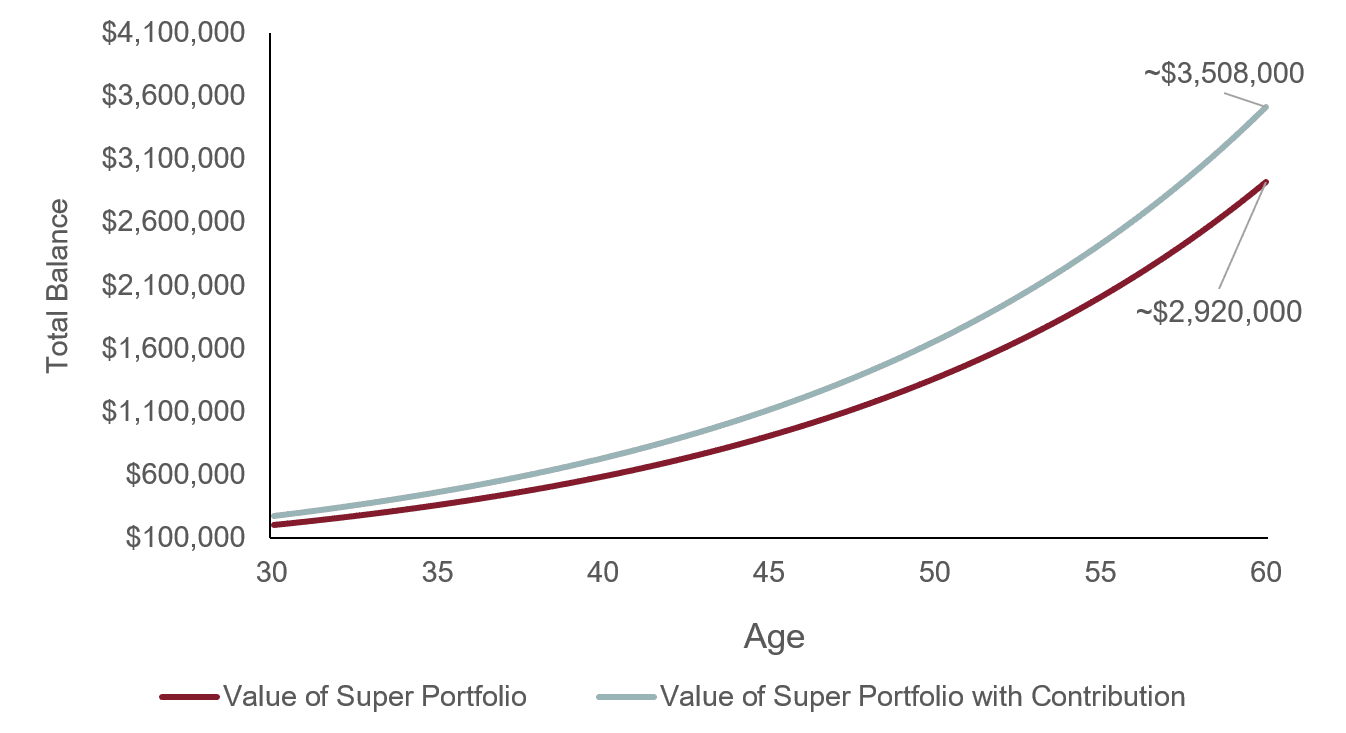

In the long term, Riley also builds significant wealth within her superannuation. With an initial balance of $200,000, regular employer contributions of $15,000 per year, and an assumed annual return of 7%, her superannuation grows to over $2.9 million in 30 years. However, by making the additional contribution now, her balance reaches $3.5 million—an extra $600,000 from her $72,500 contribution.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, insurance premiums, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of transactions or investment size of holdings.

Riley is able to make a large superannuation contribution following the sale of her apartment. Although favourable, not all individuals have this strong asset base to leverage and have instead relied on assistance from family. According to the Finder Wealth Building Report 2024, 34% of Australian parents have bought investments on behalf of their offspring. Our Insight on Gifting explores how parents can assist.

Overview

The carry forward provision is an effective strategy for individuals looking to build their superannuation, minimise their tax liability, and secure their financial future. An Evans and Partners financial adviser can offer expert guidance on concessional caps and carry-forward rules, helping you align your cash flow management with your long-term financial goals.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.