Market positive as The Fed eases

US policymakers kicked off the easing cycle in September, surprising market participants with a 50bps cut to the Fed Funds Rate. The Fed claimed victory in the fight against inflation and instead turned its attention to a softening labour market.

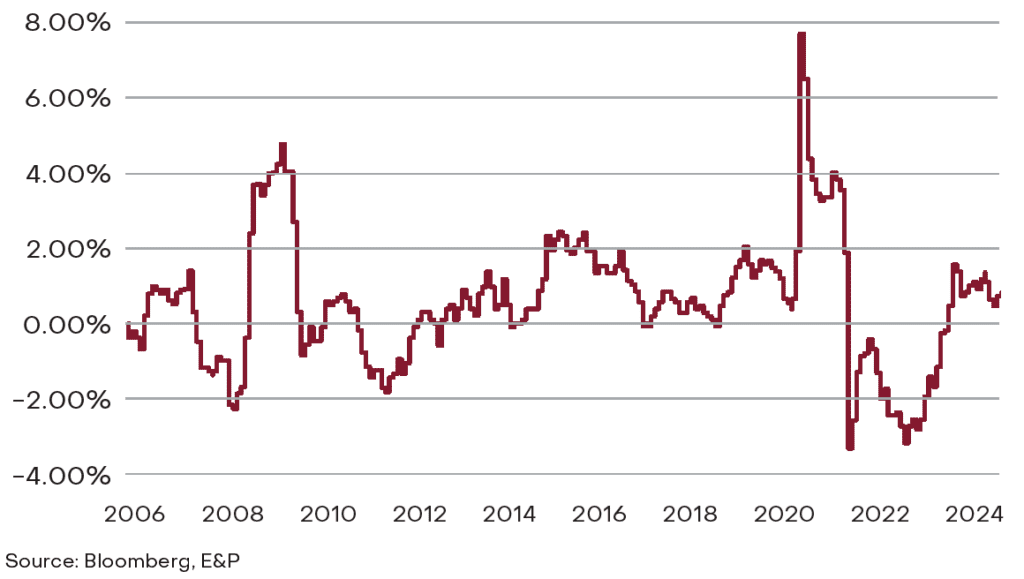

Equity markets cheered and bond markets rallied – a sharp contradiction to previous ‘emergency’ 50bps cuts (2001 and 2009) which preceded financial crises. This time does appear different. The US economy continues to exhibit promising signals. Household balance sheets and consumption levels remain in solid shape, corporate earnings and capex intentions signal upbeat confidence in the business sector, and fiscal policy continues to support employment and industries that are key to the country’s long-term strategic initiatives. At the same time, inflation has returned to ~3% while wages and average hourly earnings continue to trend at a level above this; providing a valuable boost to real incomes.

US Real Average Hourly Earnings

Seasonally Adjusted (year on year % change)

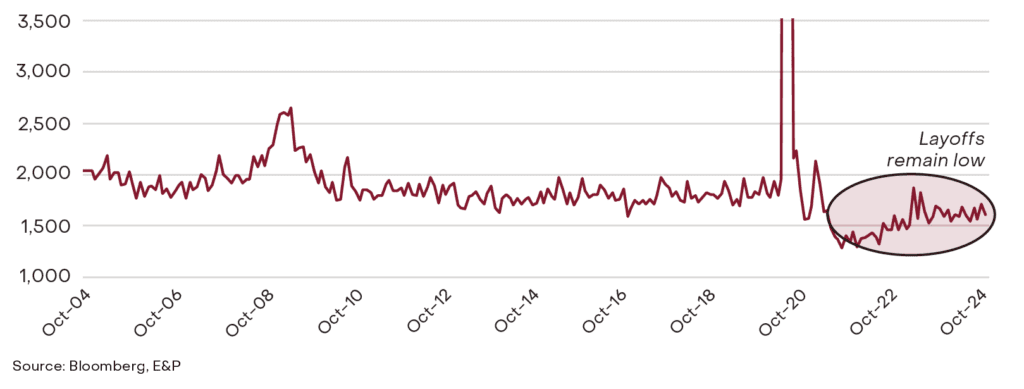

Some indicators are flashing amber though and warrant close attention. The US unemployment rate has trended higher for the past 12-months, while we have also seen weakness in forward looking indicators like job openings and quits rates. Some small businesses are also reporting headwinds to earnings via a softening demand backdrop and margin pressures, while the broader manufacturing sector remains in the midst of a sustained downturn.

Neither of these factors warrant too much concern at this juncture in our opinion. The unemployment rate still remains at a historically low level and much of the recent increase is attributable to growing labour supply (people re/entering the workforce) rather than layoffs. Confidence in small and medium sized businesses should also improve from here following the larger than expected cut in official borrowing rates.

Added to this, things are also starting to turn up in the east which could provide a valuable boost to global growth and earnings. Chinese authorities have announced a series of monetary and fiscal policy measures, including cuts to key lending rates, lower mortgage rates, and even potential cash handouts to families, in an effort to stoke consumer confidence and boost domestic consumption.

Markets have responded emphatically, with local and offshore Chinese equity markets up 20-30% from September lows. Still, it is unclear if this will prove to just be a short-lived flurry in markets, versus a catalyst for a sustained recovery in economic activity. Most anecdotes suggest that buying to date has largely been concentrated to short covering and algorithmic trading, however given investor sentiment is so poor and with market valuations at these levels, even small boosts to confidence can prompt strong market momentum.

US Job Layoffs

# Monthly job layoffs in US economy (000’s)

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.