Investing in Gender Equity

In the ever-evolving landscape of finance, investors are increasingly aware of the transformative potential of their investments in shaping positive social outcomes. Gender lens investing (GLI) has emerged as a proactive approach that not only strives for financial gains but also advocates for gender equality and the empowerment of women. GLI involves deliberately incorporating gender-related considerations into investment processes, both new and existing, with the goal of enhancing both social impact and business returns.

Gender in Stats

- Barriers to women fully participating in the workforce are costing the Australian economy $128 billion (Australian Government Women’s Economic Equality Taskforce, 2023).

- Australian women saw only 4% of total startup funding between 2018-2021 (Techboard, 2021). Yet, equal participation as entrepreneurs could raise global GDP by 3-6%, boosting the world economy by USD 2.5-5 trillion (UBS, 2021).

- If every girl received 12 years of education, the higher lifetime earnings would grow the global economy by as much as US$30 trillion (Global Partnership of Education, 2022).

- Women control over US$31.8 trillion in worldwide spending, representing 85% of consumer spending in the US (Forbes, 2019).

Investor Value

Gender lens investing is not just a matter of impact, but also financial outcomes. Research shows that boards and leadership teams with a greater gender balance contribute to improved corporate governance and risk managementi. Research also shows female lead startups, on average, generate higher return on investment (ROI) and revenue per dollar invested than male counterpartsii. Meanwhile, diverse teams have also been shown to enhance creative thinking, problem-solving and innovationiii.

By improving alignment with customers through a representative workforce, companies can also better engage a critical customer segment – women. As women control a considerable portion of discretionary consumer spending, products and services that consider diverse perspectives, can benefit from increased customer loyalty, robust brand capital and simply deliver better outcomes for customers. This has been evidenced by the runaway success of the ‘Barbie’ movie ($1.4 billion USD in global takingsiv) and 2023 FIFA women’s world cup (6.51 million average reach per match featuring Australiav).

Mind the Gap

Despite the potential to realise value for investors, our industry is falling short. There is a significant funding gap for female-led startups. Females in Australia are paid, on average, 13% less than male counterpartsvi. The financial services industry also maintains a stubborn gender underrepresentation across its workforce cohort, as do ASX200 CEO’s and board directorsvii – despite progress being made over recent years.

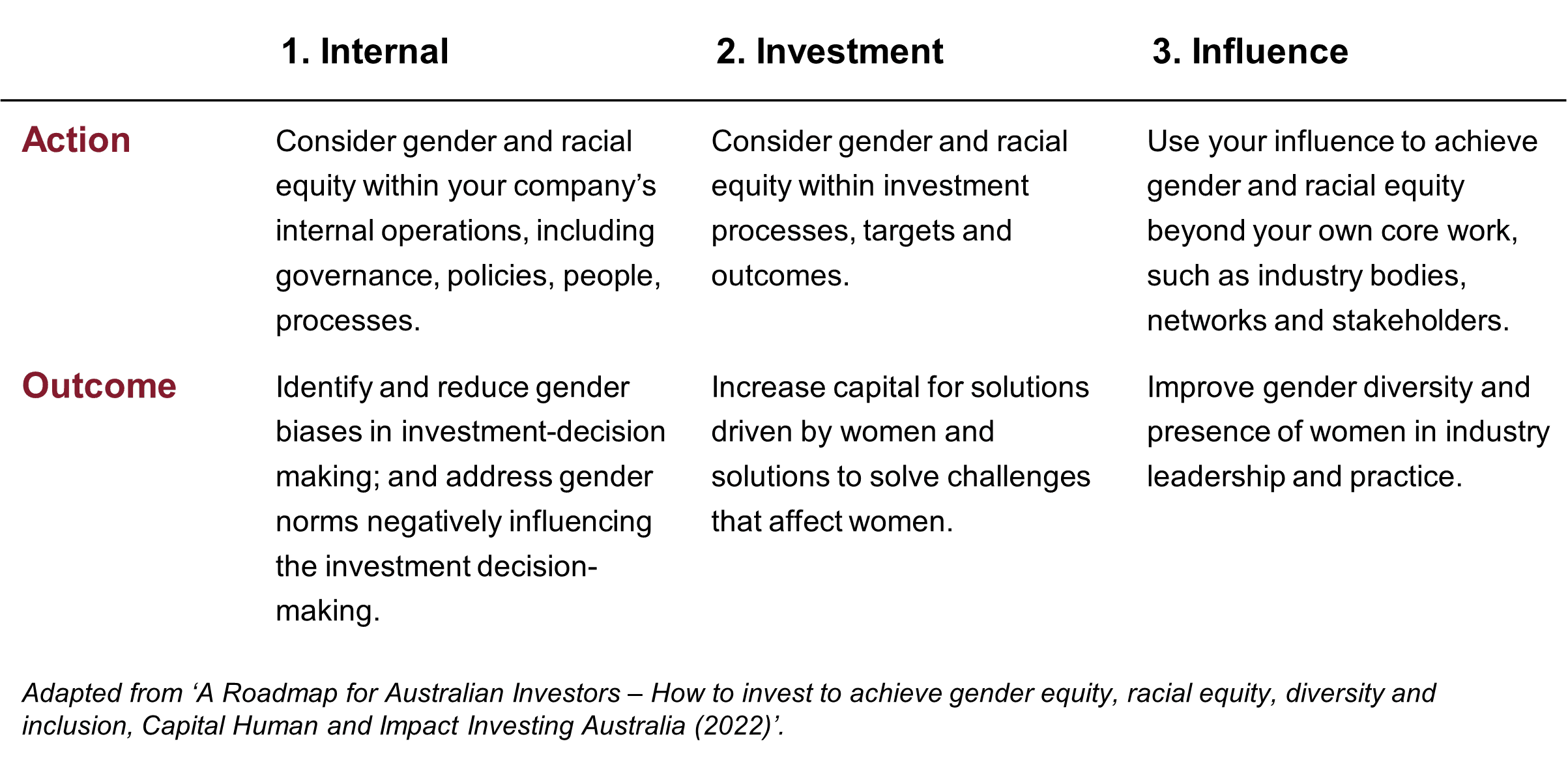

A Framework for Gender Lens Investing:

For investors and individuals hoping to support gender lens impact, we see three key avenues for actionable change across financial markets.

The Path Ahead

In the dynamic world of investment, gender lens investing is gaining momentum. Leaders in this domain recognise the untapped potential and unique perspectives that gender diversity brings to the table. ‘Investing in Gender’ will likely become a mainstream expectation for investors and companies in future. However, challenges remain, including overcoming traditional biases and ensuring that outcomes are authentic. The path ahead requires leadership, collaboration, and a commitment to genuine change.

Tags

Disclaimer

iPeterson Institute for International Economics (PIIE), ‘Women on Boards: The Impact on Corporate Governance and Risk Management’ (2018)

iiUBS, ‘The Funding Gap: Investors and Female Entrepreneurs’ (2021)

iiiMcKinsey & Company, ‘Diversity and Inclusion: The Key to Innovation and Problem-Solving’ (2015)

ivWarner Bros. Home Entertainment (2023)

vSeven Network Australia (2023)

viABS, Workplace Gender Equality Agency (2023)

viiAICD, ‘Gender Diversity Progress Report’ (2023)

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.