Infrastructure in Focus

Attractive dynamics in unlisted infrastructure assets make them a compelling proposition for investors looking to add a defensive component to a well-diversified portfolio.

Alternative assets serve a number of important roles in portfolios. There are two broad categories of alternatives: growth alternatives and defensive alternatives.

Growth alternatives

Growth alternatives include private equity and venture capital. These typically provide exposure to parts of the economy that are either poorly represented in public equity markets or not represented at all. The private equity market has changed significantly in recent years and, in our view, is now essential for investors seeking a well-diversified exposure to high returning assets.

Positive outlook for private equity

Private equity has had a subdued few years given macro uncertainty and high interest rates. Funds have struggled to realise assets since there has been no new issuance on stock markets. Nevertheless, there are real long-term opportunities in clean energy, AI, digitisation and growing healthcare needs. There has been an increase in the number of funds on offer in Australia and structures are now more investor friendly. Meanwhile, newer funds might be able to take advantage of distressed situations and be well-positioned to allocate money to growing companies at the start of a new cycle.

Defensive alternatives

Defensive alternatives include less volatile assets that should provide a more stable source of return over time, or which are lowly or negatively correlated with traditional asset classes. They include infrastructure investments, private credit, hedge funds, commodities, gold and long-short funds operating in equity or bond markets.

Attractive infrastructure

Our preferred defensive alternatives are unlisted infrastructure and private credit. Unlisted infrastructure funds typically have large exposures to transport infrastructure such as airports and freight terminals where volumes are strong as conditions normalise after COVID. Many assets also have inflation protection due to CPI-linked pricing which makes them particularly attractive at present.

The trend to private credit

The private credit market has rapidly expanded in recent years. This partly reflects growing regulatory pressure on banks that is constraining their ability to lend. 2023 was a particularly strong year when there was some pressure in listed credit markets. There is now a range of funds available with differing sector, duration and risk profiles.

All that glitters

We have been reducing exposure to gold in portfolios. Our previous position was based on its safe-haven characteristics. But we now see government bonds as better safe haven assets so we have been reducing gold holdings. Higher interest rates are also a negative for gold because they increase the opportunity cost of an asset that has no income stream.

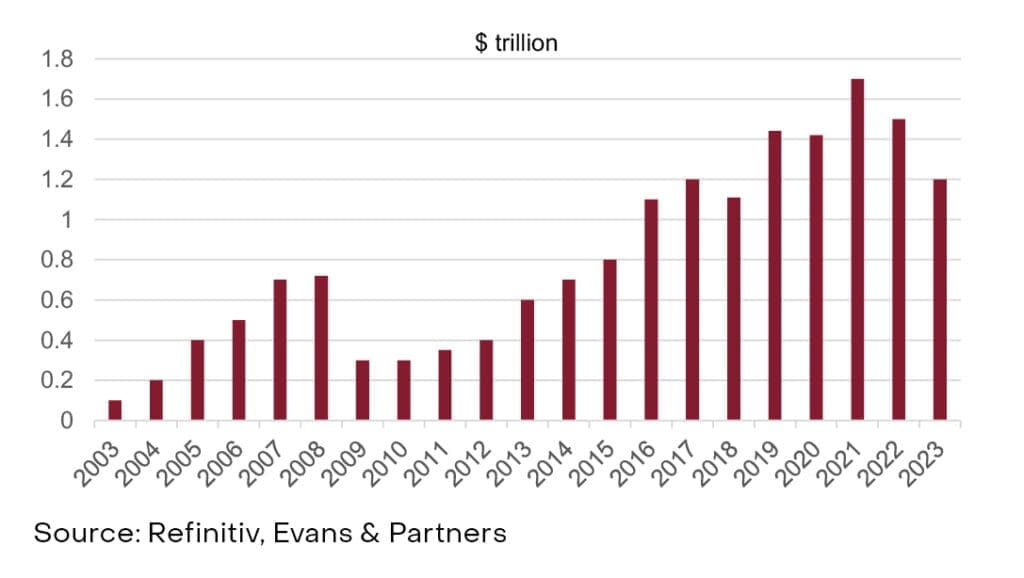

Global Private Capital Raised

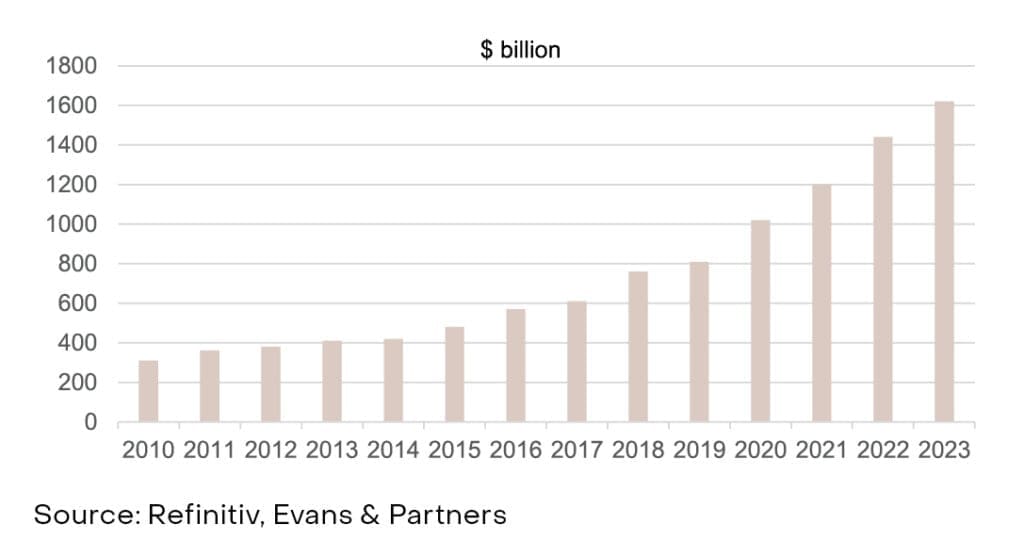

Global Private Debt

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.