Homegrown Tech Champions

Global technology stocks have driven equity market returns but Australian investors shouldn’t neglect tech opportunities closer to home.

Global equity market returns this year have been dominated by the performance of the US technology sector, notably the ‘Magnificent Seven’, but in particular Nvidia, which alone has contributed ~5% of the S&P 500’s 12% return so far this year. While the domestic S&P/ASX 200 benchmark (+1.4% YTD) has lagged the US S&P 500 index (+13.9% YTD) given its lower weight to the technology sector, there are two technology stocks listed on the ASX – NEXTDC and Block – covered by E&P’s technology analyst Paul Mason, which we believe should be of interest to investors. Both stocks are on the E&P Domestic Direct Equity Recommendations list, a compilation of the best ideas from current E&P Research coverage.

Positive on data centre dynamics

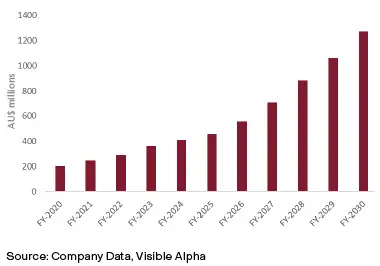

NEXTDC is the leading independent data center operator in the Australian market, which is now expanding via new developments in Asia and New Zealand. The growth of artificial intelligence (AI) applications has provided a further boost to demand growth for NEXTDC’s infrastructure and services that was already supported by growth from megatrends such as cloud computing, 5G, the Internet of Things and 3D printing. Major cloud service providers and technology suppliers are now scaling up in support of the massive data management challenges that will arise.

While there are plenty of risks related to AI for the technology sector (notably for software companies), we believe that data center companies like NEXTDC look well-placed to benefit. Industry feedback on demand remains very bullish, but there are significant constraints on supply. We believe the supply-demand mismatch is getting more favourable over time due to difficulties bringing on power in a timely manner.

Serving both sellers and consumers

Block is a highly innovative company with market leading designs and user experience offerings for both sellers and consumers. Block is leveraged to sellers through its Square ecosystem. Square grows through acquiring new customers, increasing transaction volumes through its point-of-sale solutions, and upselling software solutions. Block is leveraged to consumers through its Cash App ecosystem. Cash App grows through acquiring new customers, increasing the uptake of its Cash Card and Direct Deposit products, and now also through the uptake of its Afterpay Buy-Now-Pay- Later offering.

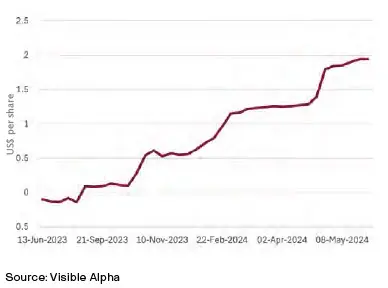

Expense discipline has materially changed Block’s profit outlook. They announced a personnel cap in late 2023 that is driving efficiency and operating leverage. We expect Block to maintain its recent pace of earnings guidance upgrades and sustain high growth for a long time. We believe the market is still underestimating the earnings power of the business. Management intends to reach the ‘Rule of 40’ target in 2026. This is a measure of operating performance for technology companies based on achieving revenue growth plus free cash flow growth above 40%. Block achieved 29% in 1Q24.

NEXTDC Revenue Growth History and Forecasts

Block: Revisions to Consensus FY24 Earnings Per Share Forecasts

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.