Going nuclear

Nuclear energy, once heralded as a clean and limitless source of electricity, has faced significant challenges in recent decades. Largescale nuclear catastrophes, such as Chernobyl and Fukushima, raised serious concerns about the safety of nuclear power plants and led to a decline in public support. However, as the world grapples with the urgent need to reduce greenhouse gas emissions, there is renewed interest in the space.

Here we look at key issues to consider when assessing if the sector is a ‘viable’ long term option for sustainable investment, and what issues need to be addressed.

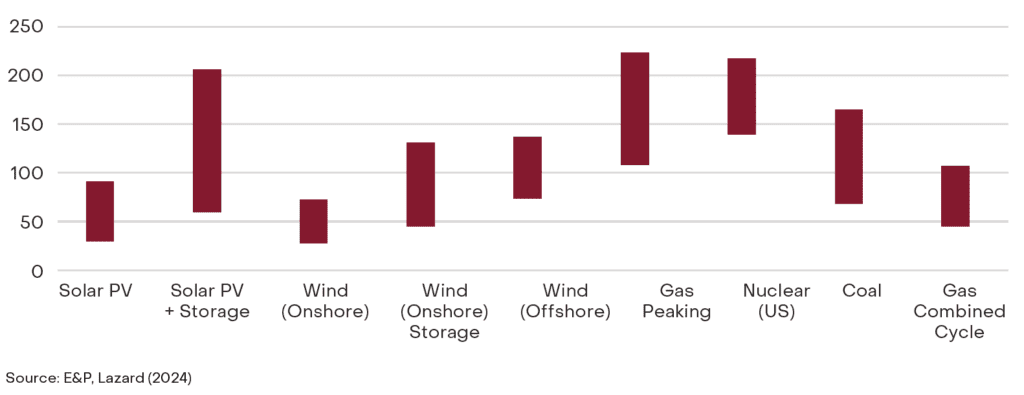

- Construction and generation costs: According to most estimates, on a levelised energy cost basis, nuclear power is currently expensive. This is largely due to the significant upfront capital required. Further, increasing fluctuations in daily electricity pricing – where prices are often negative due to the low marginal cost of wind and solar – can severely impact the economics of baseload generation. While this may change in future with electricity growth from data centres – for now uncertainty remains.

- Difficulties with forecasting: Evidence from new build reactors in the OECD region shows cost and timeframe estimates are very difficult to forecast with any accuracy given construction timeframes can extend across multiple decades. While the industry holds great hope for new technology – such as small-modular reactors (SMR) – this is largely unproven and difficult to assess given data opacity from the limited number of current operating plants.

- Supply chain concentration: The supply chain for nuclear technology is concentrated, with only a few major players dominating the market. While Australia is the world’s fourth largest producer of uranium ore, it is enriched uranium that is used as a nuclear fuel. This market is monopolised by Russian state owned enterprise Rosatom, which according to various sources has approximately 40% of the world’s uranium enrichment market – creating significant geopolitical risk.

- Waste management: The safe and long-term storage of nuclear waste remains a challenge. High-level nuclear waste, which is radioactive and has a long half-life (the amount of time it takes for one half of the radioactivity to decay), requires careful disposal. The availability of suitable storage facilities and the long-term costs associated remain difficult to navigate. For example, since 1987 a disposal facility has been planned in Nevada. This was intended to be the long-term storage facility for the American nuclear industry, however, the project has never been completed due to its political opposition.

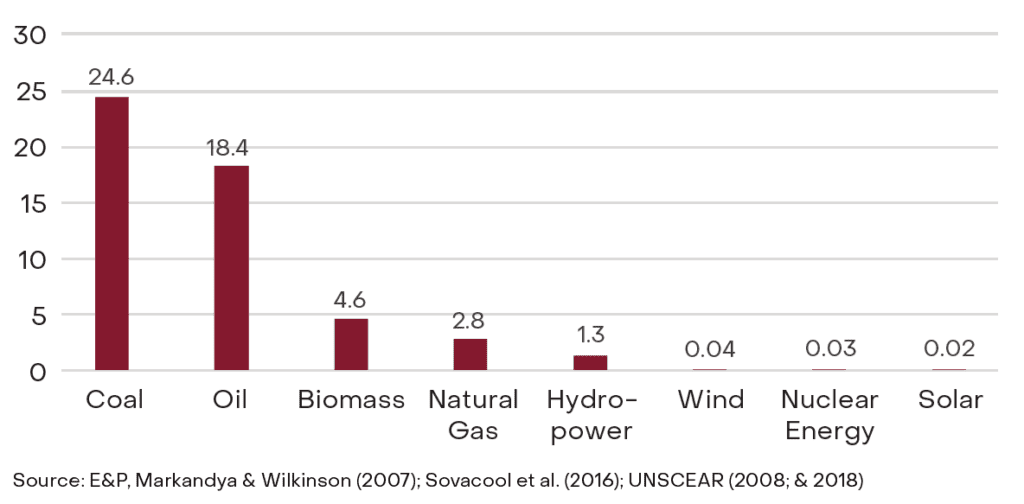

- Safety and regulation: Nuclear accidents, such as Chernobyl and Fukushima, have raised concerns about the safety of nuclear power plants. However, the rate of deathsper- terawatt-hour for nuclear energy is small compared to alternative energy sources. Despite this (and while low probability), displacement and associated economic costs of incidents can be much higher. For example, the Fukushima Daiichi nuclear disaster in 2011 led to the evacuation of over 160,000 people and cost an estimated $180 billion in damages.

Death rates per unit of electricity production (per Twh)

Nuclear energy remains a complex and multifaceted issue, with a delicate balance of benefits and risks that are difficult to weigh against each other. However, from an investment perspective, it appears difficult to justify private capital allocation given the inherent difficulties in forecasting coupled with extended payback periods and geopolitical vulnerabilities of supply chains. In this case, government investment is likely required to support the development and further deployment of nuclear energy to address the urgent need for decarbonisation.

Levelised cost of energy by technology type ($US per MWh)

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.