Filling the Hybrid Void

Hybrid securities, also known as Additional Tier 1 (AT1) Capital, have long been favoured by income-focused investors. Their ability to provide a stable income stream and capital stability, based on the robustness of our major banks’ balance sheets, has made them desirable for retail investors. Typically issued by banks and insurers, these securities offer higher yields than traditional credit instruments such as senior and subordinated bonds. However, the important “hybrid” component arises from incorporating equity-like features, such as discretionary distributions and convertibility into equity as a buffer for financial losses incurred by the issuer.

APRA Reforms and Hybrids Phase-Out

Regulatory changes by the Australian Prudential Regulation Authority (APRA) are phasing out hybrid securities from our major banks. This will commence from the 1st of January 2027, although some issuers have already started redeeming their hybrid securities. All hybrids must be removed by 2032. These initiatives aim to bolster financial stability by mandating that banks maintain higher-quality capital, prompted by the challenges faced by international banks in recent years. Investors must shift their attention to alternative fixed-income options to fill the void in the income-producing part of their investment portfolios.

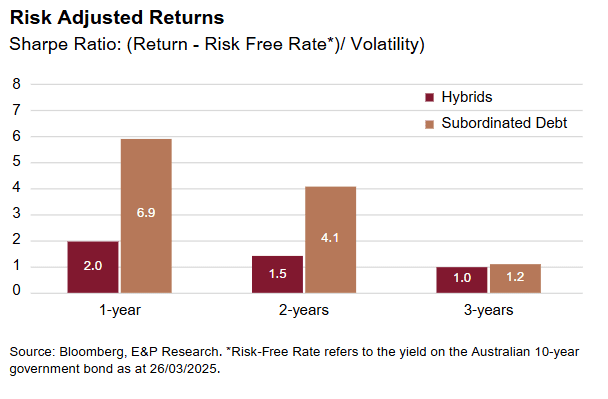

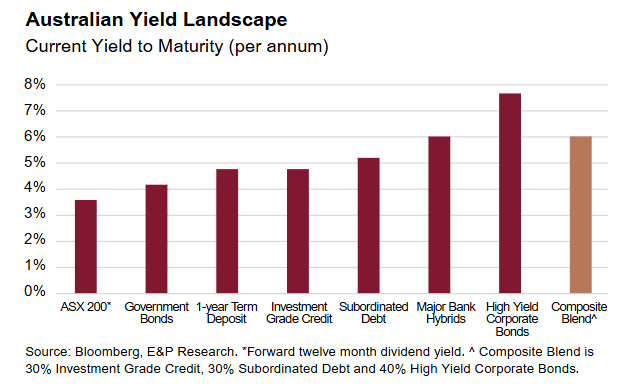

The most obvious replacement is subordinated debt which is defined as Tier 2 regulatory capital. This is primarily issued by banks and insurers and ranks below senior debt but above equity and hybrids in the capital structure. It plays a crucial role in absorbing financial losses before they impact senior creditors, thus offering an additional layer of protection for depositors and policyholders. These bonds typically offer floating rate yields lower than hybrids; however, investors are compensated with lower volatility and less correlation to equity markets. Investors can gain exposure to Tier 2 markets directly (wholesale only) or via ASX-listed vehicles (exchange traded funds (ETFs)) such as the VanEck Subordinated Debt ETF (SUBD), which is currently offering a running yield of 6.1% per annum with an average A- credit rating.

Other potential hybrid replacements are traditional investment-grade and high-yield credit instruments.

These rank as senior in the capital structure, meaning creditors are required to repay these lenders first in the event of default. For bonds to achieve investment-grade status, they must surpass a certain credit rating from agencies like S&P Global, Fitch Ratings, and Moody’s. Anything below an investment-grade rating is classified as high yield, which is deemed lower quality than traditional credit. However, investors are generally compensated for this higher risk through higher yields. By blending these instruments, investors can better diversify their fixed-income portfolio given issuance across a multitude of countries and sectors, not just by Australian banks and insurers. Noteworthy options include the Betashares Australian Investment Grade Corporate Bond ETF (CRED), with a yield-to-maturity of around 5.6% per annum, a BBB+ credit rating, and exposure to up to 50 Australian issuers.

We remain constructive on the Australian credit environment given elevated all-in yields, reasonable valuations (credit spreads), solid corporate fundamentals, and a supportive macro backdrop.

Life After Hybrids

As the hybrid era reaches its end, investors must look elsewhere to diversify the income of their Interest Rate Security portfolios. While no single alternative perfectly replicates hybrids, diversifying exposure across subordinated debt, investment grade and high-yield corporate bonds can provide excellent income opportunities with a favourable risk-reward profile. Many market participants are aware of the need to fill this gap, and we expect to see new developments come to market in the fixed-income space, but only time will tell how suitable a substitute they prove to be – we will assess each on its merits.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.