Explainer: Bonds Versus hybrids

As an asset class, fixed income forms an integral part of many diversified investment portfolios. This article explains the different roles played by bonds and hybrids in the fixed income category, in the context of the current investment environment.

What is a bond?

A bond is a type of security issued – either by the government or a company ― under which the issuer owes the holder of the bond and is obliged (depending on the terms) to repay the principal of the bond at the maturity date, as well as interest over a specified amount of time.

Interest is usually payable at fixed intervals and these payments are known as coupons. The benefit of owning a fixed rate bond is that investors have certainty about how much interest they will earn and for how long. As a result bonds are generally viewed as a stable and predictable income source.

As long as the bond issuer does not default or call in the bonds, the bondholder can predict exactly what their return will be on the investment. However, the risk of owning long-dated fixed bonds (also called duration) is that if rates start to rise, the capital value of that bond will fall.

The aim as a bond investor is to lend money to a borrower for the highest unit of return and the lowest amount of risk, with a view to considering if the amount will be paid back.

What is a hybrid?

A hybrid security, often referred to as a ‘hybrid’ is a single financial security that combines two or more different financial instruments. Hybrids generally combine both debt and equity characteristics and are another way for banks and companies to borrow money from investors.

Hybrids can provide income ― generally by paying a fixed or floating rate of return until a set date ― but just as their value can rise, their value can also fall and there is no guarantee on the amount and timing of interest payments. As a result, hybrids demand a higher risk premium than bonds.

When you own a hybrid, the issuer can convert it into equity at a certain date in the future. For example, in financially challenging times bank hybrids could be converted to bank shares, or a company issuing hybrids may choose to defer interest payments or not repay investor capital.

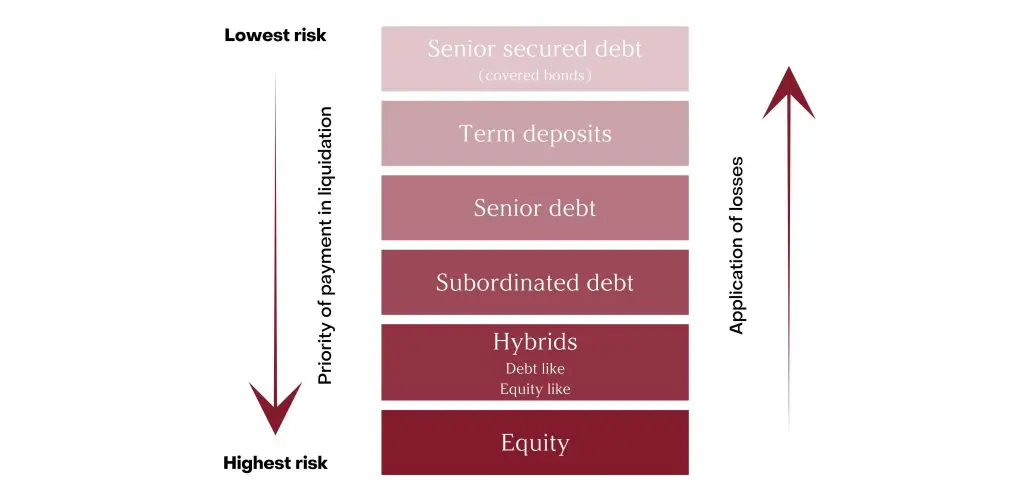

Where do both options sit within a capital structure hierarchy?

Bond investors sit at the top of the capital structure. When an investor buys shares, they own equity in the company. In the event of a collapse of the company, application of losses occur from the bottom up of the capital structure. Returns increase the lower you go down the capital structure.

Pricing a floating rate security and a fixed rate bond

Floating Rate Securities (or floaters) are a common tool that investors use to benefit from rising rates. The yield to maturity (YTM) on a floating rate security is calculated by adding the 3-month bank bill swap rate (BBSW) or base rate plus the issue margin, otherwise known as the risk premium.

For example, if Bank A today announced a new hybrid deal with an issue margin of 4.00 per cent or (400 basis points), a product issuer could add the current 3-month BBSW of 2.00 per cent for a total YTM of 6.00 per cent and a coupon of 6.00 per cent.

This coupon would then reset each quarter corresponding to the underlying 3-month BBSW. And if the base rate rises to 3.00 per cent, the coupon for the next period would be 7.00 per cent.

If you look at the scenario above, the same can also work in reverse where if the base rate drops, so too does the value of the coupon. Therefore, it is important to have a blend of fixed and floating rate securities in a balanced portfolio.

Pricing a fixed rate bond works much like the floating rate note example.

For example, if Company B wanted to issue a 5-year fixed rate bond and the risk premium they need to pay is 2.00 per cent above the 5-year swap rate ― the same BBSW used for floaters ― by using the current 5-year swap rate of 3.50 per cent this would then see a bond yield of 5.50 per cent YTM.

This shows that rising rates impact the cost of funding for corporates. Therefore, if Company B issued the same bond in December 2021 when the 5-year swap rate was 1.50 per cent, the total cost or YTM would have been 3.50 per cent.

Why should we look at buying fixed income when rates are rising?

Regardless of an individual’s view on the direction of rates, there are always opportunities in fixed income. And when there are such rapid rises in interest rates as has already occurred this year, it can present an opportune time to buy corporate or government bonds at deeply discounted levels.

An investor can choose to take a low duration of a floating rate lens where higher rates equates to higher income through floating rate bonds ― or take a higher duration lens and buy discounted fixed rate paper, such as corporate bonds or government bonds.

A popular option is to choose a low duration fixed income portfolio strategy developed by a specialist investment manager to preserve capital and provide a predictable income stream over the typical business cycle.

If you are considering investing in fixed income, please speak to your adviser.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiaries of E&P Financial Group Limited (ABN 54 60 9913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.