Downsize your home, upsize your super

The decision to downsize from the family home can involve a mix of emotional and practical considerations. While the motivator is often a lifestyle change, whether that be to have less maintenance, needing less space, or to be closer to children, there are also significant financial incentives for retirees worth considering.

What is the Downsizer Super Contribution?

The Downsizer Super Contribution is an initiative by the Australian Government designed to encourage older Australians to downsize their homes and boost their retirement savings.

Introduced as part of a range of superannuation reforms in 2018, it allows eligible individuals over age 55 to contribute up to $300,000 per person, or $600,000 per couple, from the sale of their primary residence into their superannuation fund.

Interestingly, you do not actually have to buy a smaller or cheaper home to take advantage of the downsizer super contribution. The act of selling your home, provided you meet the eligibility criteria, allows you to make the contribution provided you do so within 90 days of settlement. For a full list of the eligibility criteria visit the ATO website.

Benefits of the Downsizer Contribution

- Boost Retirement Savings: The most apparent advantage is the ability to add a significant amount to your superannuation, which can then earn income and grow in a lower taxed environment and offer a tax-free income stream during retirement.

- Further, even if only one member of a couple owns the home, both people can make a downsizer contribution potentially providing a boost to their super balance of $600,000. For a 65 year-old couple, this could provide an additional $30,000 in tax-free retirement income.

- No Contribution Cap Restrictions: The downsizer contribution is not subject to the standard superannuation contribution caps, making it an effective way to increase your retirement savings without facing penalties or limits.

- No Work Test: People over 67 are usually required to meet a work test to make voluntary contributions to super. Those over 75 can’t make voluntary contributions at all. However, the downsizer contribution bypasses these rules, giving older Australians more flexibility to contribute money to super.

Hidden opportunities

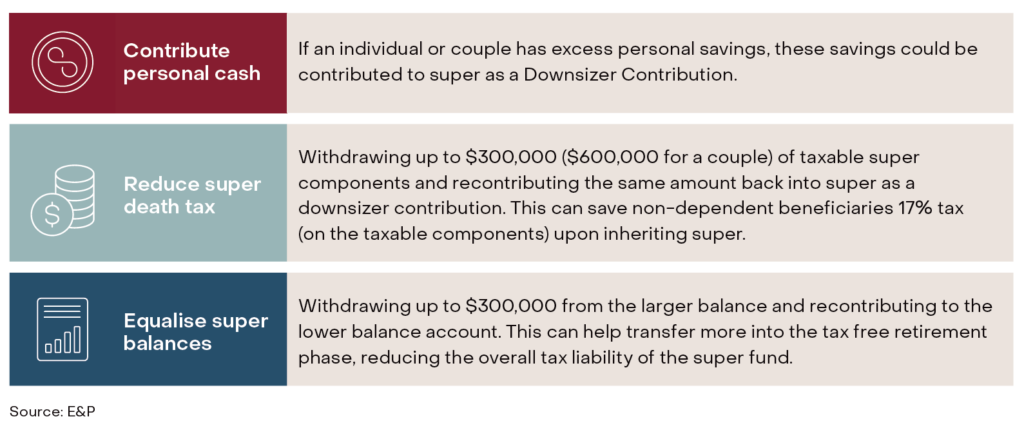

The simplest scenario is where downsizing to a home of lesser value allows someone to contribute up to $300,000 of the proceeds to super. However, with current property prices, a smaller home doesn’t necessarily mean a cheaper home. Even if this is the case and you downsized to a home of equal value, there are opportunities to utilise the Downsizer Super Contribution. Some of these strategies include:

Potential Downsides

- Aged Pension impact: While the Downsizer Contribution helps boost super, individuals need to be mindful that any amount contributed to super may affect their eligibility for the Age Pension. The additional wealth in super may push them over the asset thresholds, which may reduce or eliminate Age Pension entitlements.

- One-Time Use: The scheme can only be used once, limiting its long-term flexibility. Once you’ve made the Downsizer Contribution, you cannot access the same benefit for another property sale.

- Impact on Transfer Balance Cap: For those eligible to transfer their downsizer contribution to a retirement pension, this will utilise some or all of their remaining pension balance transfer cap.

Plan ahead

The strategies surrounding the Downsizer Contribution are complex and require working through various elements. Careful planning is also required, especially for those who are eligible for the Age Pension, as the contribution could impact their entitlements. However, despite the complexity, it’s worth considering given the Downsizer Contribution for most retirees, will be the last opportunity to boost or improve the structure of their super.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.