Division 293 Tax Explained: What High-Income Earners Need to Know

While superannuation is a tax-efficient means to save for retirement, there are important implications to consider as your personal income increases. As your income exceeds $250,000 per year, you may incur an additional levy, known as the Division 293 tax, on your concessional (pre-tax) super contributions. As the Division 293 tax requires individuals to nominate how its payment is funded, it is important to understand your options and their long-term implications.

What is the Division 293 tax?

Concessional contributions—typically those made by your employer, through salary sacrifice arrangements, or as personal transfers where a tax deduction is claimed—attract a 15% tax, which is deducted by your super fund upon receipt. The Division 293 tax applies an additional 15% tax on contributions for high-income earners, potentially increasing the total tax rate to 30%. At this rate, individuals still receive a tax benefit of approximately 17% compared to the personal income tax rate of 47% (including the Medicare levy).This means high-income earners receive a similar tax saving (i.e., 17%) to lower-income individuals in the 32% and 39% tax brackets (including the Medicare levy), who also pay 15% on super contributions.

The Australian Tax Office (ATO) will issue a Division 293 tax assessment if:

- Your income exceeds $250,000, or

- Your income is below $250,000 but exceeds this threshold when concessional contributions are included. Contributions in excess of your concessional limit are not included for Division 293 purposes.

For the purposes of Division 293 tax, income is calculated as the sum of:

- Taxable income (assessable income minus allowable deductions)

- Total reportable fringe benefits amounts

- Net financial investment loss

- Net rental property loss

- Net amount on which family trust distribution tax has been paid

Once these income sources are totalled, the ATO subtracts any amounts released through the First Home Super Saver scheme and super lump sum taxed elements with a zero-tax rate.

How is the tax calculated?

The Division 293 tax is 15% and is levied on the lesser of:

- Your super contributions (noting excess contributions are not subject to Division 293 tax), or

- Your excess income over the $250,000 threshold.

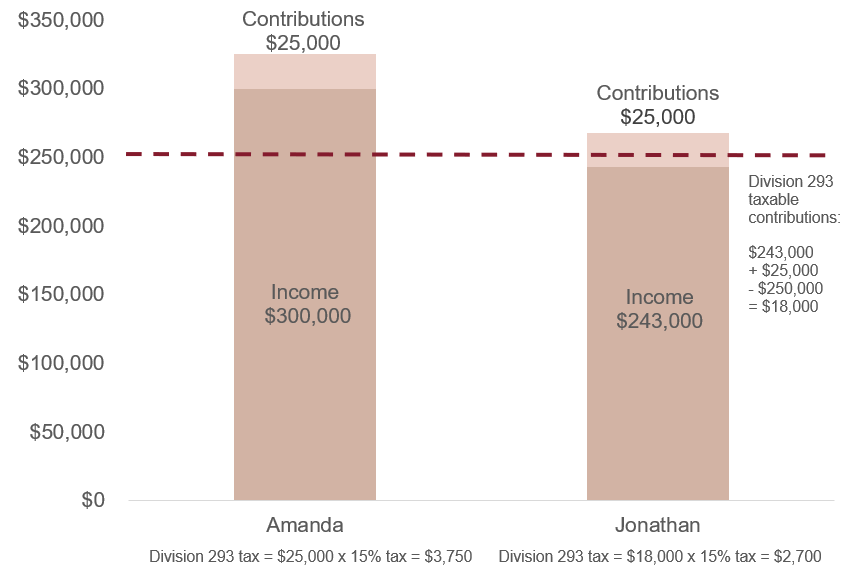

These two scenarios are illustrated by Amanda and Jonathan. As shown below, Amanda is subject to the Division 293 tax as her income of $300,000, combined with her super contributions of $25,000, exceeds the $250,000 threshold. A 15% tax is levied on her contributions, resulting in a tax payable of $3,750.

Conversely, Jonathan has an income of $243,000, but the addition of his $25,000 super contributions takes him over the threshold. As a result, Jonathan pays additional tax only on the portion of his contributions that exceed the threshold (i.e., $18,000).

Source: E&P

How can you pay the tax?

If you are liable for Division 293 tax, the ATO will issue an assessment notice after processing your income tax return and receiving information from your super fund. The notice will detail the amount owed and the due date for payment, which can be made by:

- Releasing funds from your superannuation balance, or

- Paying the ATO using personal cash reserves.

While releasing funds from superannuation can be a straightforward solution, careful planning through the year can help ensure you have sufficient cash to fund the liability personally. Over the longer term, the difference such a decision makes can be significant.

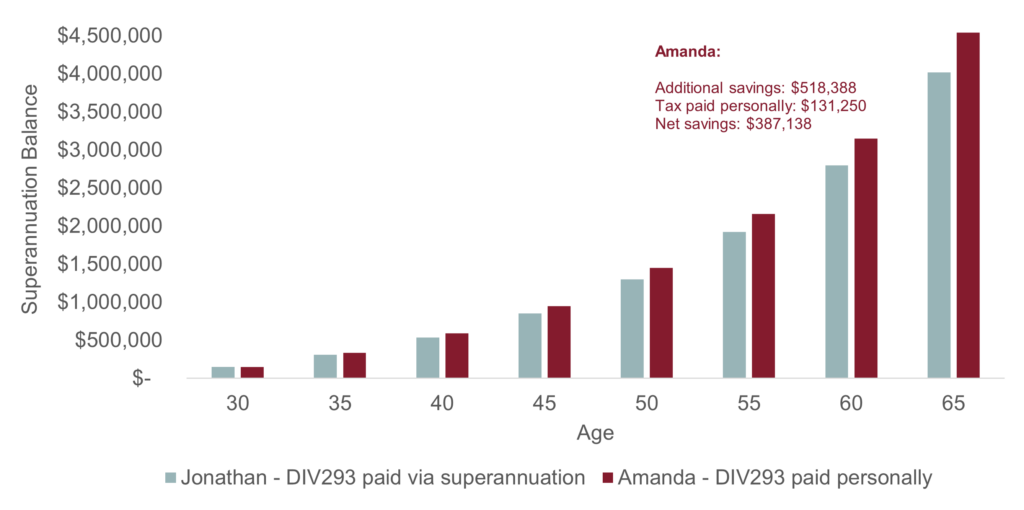

Consider Amanda and Jonathan: Amanda budgets for her tax payable and elects to fund it from her personal savings, whereas Jonathan opts to pay the liability from his super fund. For simplicity, we have assumed both individuals have a Division 293 tax payable of $3,750 each year. With a $150,000 balance and a 7% annual return, Jonathan’s superannuation grows to $4 million over 35 years, while Amanda’s balance reaches $4.5 million—an additional $518,000.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of transactions or investment size of holdings.

Overview

Despite the Division 293 tax being an additional burden on higher-income earners, the benefits of investing via superannuation remain. The total tax of 30% is lower than the personal income tax rates typically associated with high earners (i.e., 47%, including the Medicare levy). An Evans and Partners financial adviser can help identify the key considerations for funding your tax liability and outline the longer-term implications of such decisions. Due to the effects of compounding, these choices can have a meaningful impact on your retirement outcomes.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.