Contribution Splitting for a Better Retirement

The new financial year is a good time to get on top of finances. In particular, for couples managing their finances collectively, implementing strategies to equalise their super accounts can help strengthen their overall financial position in retirement.

The strategy referred to as ‘spouse contribution splitting’ is typically implemented in July and allows couples to potentially increase the amount they can hold in the tax-free pension phase in retirement. A couple’s ability to access superannuation and their eligibility for certain entitlements may also be improved as a result of implementing this strategy each year.

What is spouse contribution splitting?

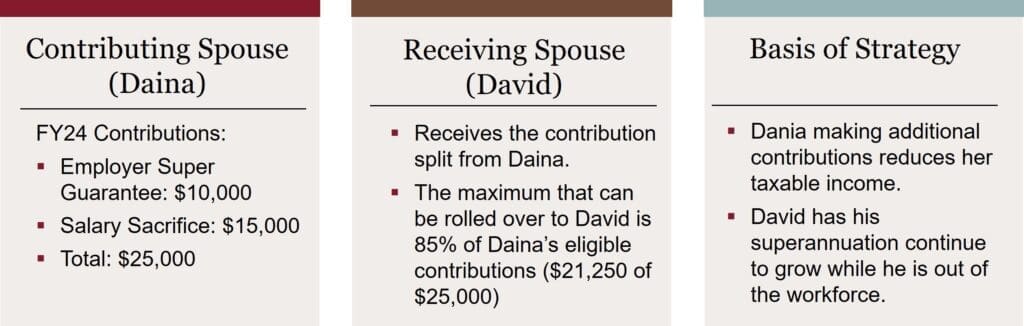

Spouse contribution splitting is a process where one spouse (the contributing spouse) transfers up to 85% of their superannuation contributions made in the previous financial year to their partner (the receiving spouse). The maximum is 85% because 15% is taken out for contributions tax. Contributions that can be split include employer contributions, salary sacrifice arrangements and personal contributions, but excludes any contributions that have already been taxed, such as after-tax contributions. These contributions must be within regular contribution limits (discussed here).

To illustrate how a couple may use contribution splitting, take the example of Daina and David. Daina is currently working fulltime as a consultant while David is caring for their young family. Through the year, Daina’s employer contributes to superannuation, and she adds to this through a salary sacrifice arrangement. Daina and David engage in a spouse contribution strategy as outlined below.

Benefits of spouse contribution splitting

- Balancing super accounts: Over time, income disparities and career breaks (often for childcare) can lead to significant differences in superannuation balances between spouses. Contribution splitting helps to balance these accounts. In addition, there is a maximum of $1.9 million which can be held in the tax-free retirement phase of super. Equalising super balances, especially when one partner is approaching this limit, can help a couple hold a higher amount of their combined superannuation in this tax-free environment.

- Tax optimisation: Where there is a significant difference in income between spouses, making additional concessional contributions under the higher-income earning spouse can be beneficial. This will entitle the higher-income spouse to a larger tax saving while the contribution can ultimately be received by the lower-income spouse.

- Early access to funds: If one spouse is significantly older than the other, spouse contribution splitting can provide earlier access to superannuation. The older spouse’s superannuation can be accessed once they reach preservation age, which can be advantageous for financial planning and liquidity.

- Maxmising eligibility for benefits: By equalising superannuation balances, couples might be better positioned with respect to select benefits and schemes. For instance, carry-forward concessional contributions are available to those with a super balance below $500,000.

Considerations and eligibility

To be eligible to utilise spouse contribution splitting, the receiving spouse must be under the age of 65 and not retired. Other considerations include:

- Timing: Contributions can only be split in the financial year after they were made. For example, concessional contributions received during the 2023-24 financial year can be split with your spouse until 30 June 2025.

- Amount: The maximum amount that can be split is the lesser of 85 per cent of the concessional contributions made or the contributions cap for the financial year (which may include unused concessional contributions where eligible).

- Administration: Where the member plans to claim a tax deduction for super contributions in their individual tax return, they must ensure they submit a notice to claim a deduction before they make the super contributions splitting request. The splitting request must also be made to their super fund via a contribution splitting form.

- Contribution caps: The contributions count towards the contributing spouse’s concessional contribution limit and splitting the contributions to their spouse does not reduce the amount counted towards their limit. The contribution split is received as a rollover of benefits in the receiving spouse’s fund and does not count towards the receiving spouse’s concessional contribution cap.

- Estate planning: Once contributed, it is important to ensure your estate planning arrangements are up-to-date and remain valid. In particular, a binding death benefit nomination form will be utilised to determine where contributed money is directed in the event of one’s passing.

Overview

Spouse contribution splitting is a valuable strategy for couples looking to optimise their combined retirement savings and tax positions. An Evans and Partners financial adviser can help assess your financial situation and outline how your family can benefit from a spouse contribution splitting strategy.

Tags

Important information

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.