Capital market updates: Adapting to economic shifts

We have updated our long-term capital market assumptions to reflect the current period of significant economic transition. We have moved from a time of ultra-accommodative monetary policy, persistently low inflation, and fiscal restraint to a period of conventional monetary policy, two-way inflation risks, and fiscal malfeasance. The changing environment demands that we re-test not only our existing assumptions and formulas, but also the approaches we take to asset allocation and portfolio construction.

Our forecasts for a ‘balanced portfolio’ (+6.8%) are fractionally lower than last year, largely thanks to more conservative equity and credit assumptions following a strong period of performance. We have upgraded our US growth (+2.2%) and cash rate (+3.5%) assumptions to reflect the ongoing resilience of the US economy in the face of restrictive monetary policy, as well as growing bipartisan support from both sides of government to run large fiscal deficits in support of long-term strategic initiatives.

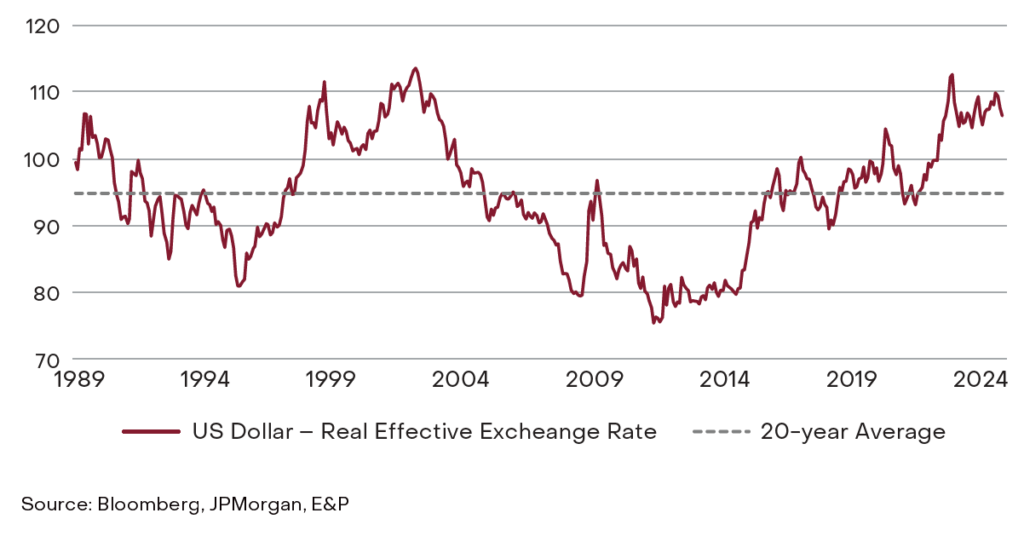

US Dollar Strength

Citi Broad Effective Exchange Rate (REER)

We also upgraded our European (+2.3%) and Japanese (+1.8%) inflation forecasts in response to growing evidence of entrenched wage inflation. In contrast, our Chinese growth (+3.9%) forecasts are lower to reflect the structural headwinds (property supplydemand imbalance, ageing population, geopolitical tensions) buttressing the world’s second-largest economy. Naturally, this has flow-on effects for key trading partners such as Europe and Australia though we remain cognisant that the policy direction in China remains subject to change.

We have also considered a range of alternative economic scenarios that present both upside and downside risks to our forecasts, namely:

- An artificial-intelligence linked boom which would boost developed market GDP by 1.0%- 3.0% over a 10-year horizon. We interpret that developed market equities such as the US would likely be the largest beneficiaries given greater scope for automation and more advanced R&D programs.

- Persistent inflation volatility as structural forces such as the energy transition, deglobalisation and ageing demographics create demandsupply\ imbalances. We would expect this scenario to trigger shorter and sharper economic cycles and higher risk premiums in assets such as equities and credit.

- A period of sustained US Dollar devaluation as the Euro and Yen exit negative interest rate regimes and the US Government’s fiscal position continues to deteriorate. This could prompt capital flight from USD denominated investments and act as a headwind to any offshore unhedged investments for Australian investors.

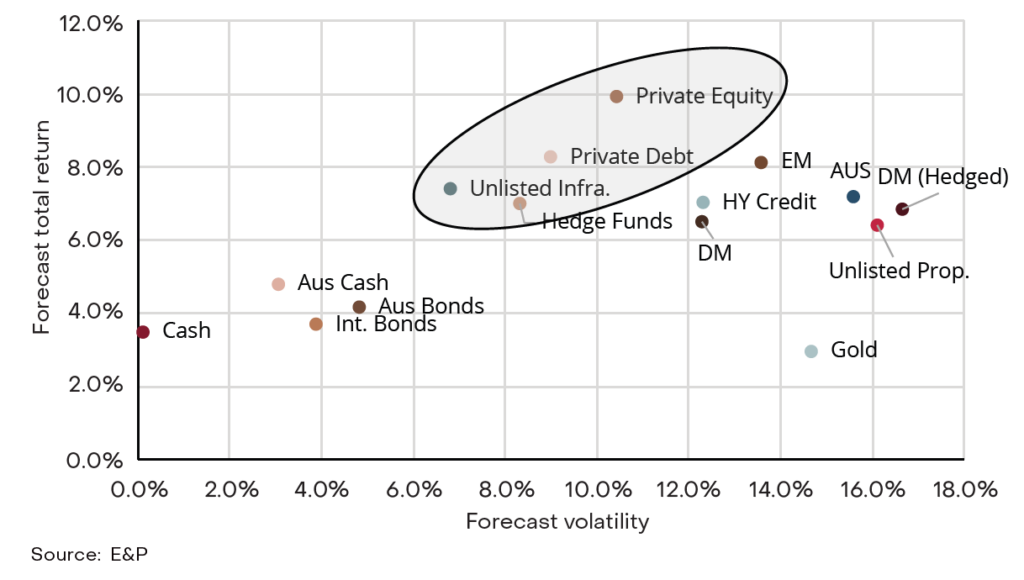

Risk & Reward: Sub-Asset Classes

Forecast total return and volatility assumptions

The implications for portfolios should not be understated. Inflation risk is now two-way, meaning investors must have reasonable allocations to both defensive and risk assets as a means of hedging against recession and generating positive real returns. While we remain confident that the global economy can gradually glide to a soft landing, we remain cognisant that economies are fragile and policy missteps could prompt an inflation overshoot or trigger

recession.

We think alternative assets such as private credit, private equity and unlisted infrastructure can play a pivotal role here, as these assets have a proven track record of delivering risk-adjusted returns whilst also contributing valuable diversification benefits through lowly correlated returns. We continue to advocate for our clients to build on current allocations, noting the investment universe is becoming increasingly accessible to wholesale and retail investors via innovative and fee efficient vehicles.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.