Can this banks rally last?

Major bank share price performance has surprised to the upside in the past year. For the rolling 12 months to 23 September 2024, the total return (share price increase plus dividends) for ANZ has been +34%, CBA +47%, NAB +43% and WBC+67%, all outperforming the S&P/ ASX 200 benchmark considerably (+20.5%). This outperformance has been contrary to our expectations, given that we have not had a Positive recommendation on any of the ‘big 4’ banks.

We are not alone when it comes to concerns about the valuations of the major banks, with Commonwealth Bank in particular defying expectations of ‘sell side’ analysts. According to FactSet data, 13 of the 16 analysts covering CBA have a negative view, while only one analyst has a positive recommendation. This level of negative consensus is extremely rare, evidenced by average sell-side price target which is currently ~40% below the share price.

So why has the sell-side analyst community got this wrong in recent times? Arguably, there have been several ‘top-down’ themes acting as tailwinds for the Big 4 banks, driving share prices higher in spite of ‘bottom-up’ fundamentals.

These include:

- Passive Management: Higher use of passive/ index funds (i.e., ETFs) is driving money towards large index constituents such as CBA (9.5% of the S&P/ASX 200 benchmark), NAB (4.9%), WBC (4.7%), and ANZ (3.9%).

- Institutional Allocations: Government mandated performance tests mean that super funds’ portfolios are now run with a lower risk appetite, driving a move to be around market weight in banks where previously they might have been underweight.

- Risk Reduction: Strong negative views on Chinese equities have driven benchmark aware investors in the region to increase their weightings in Australia to offset risk. Given the desire for domestic exposure, these flows have favoured the Big 4 banks relative to ‘China proxies’ like BHP.

- Rebalancing: The strong outperformance of the banks has forced local active fund managers to manage risk and reduce their underweight positions.

Earnings revisions in recent months have been stable to positive in the banking sector. These have been helped by

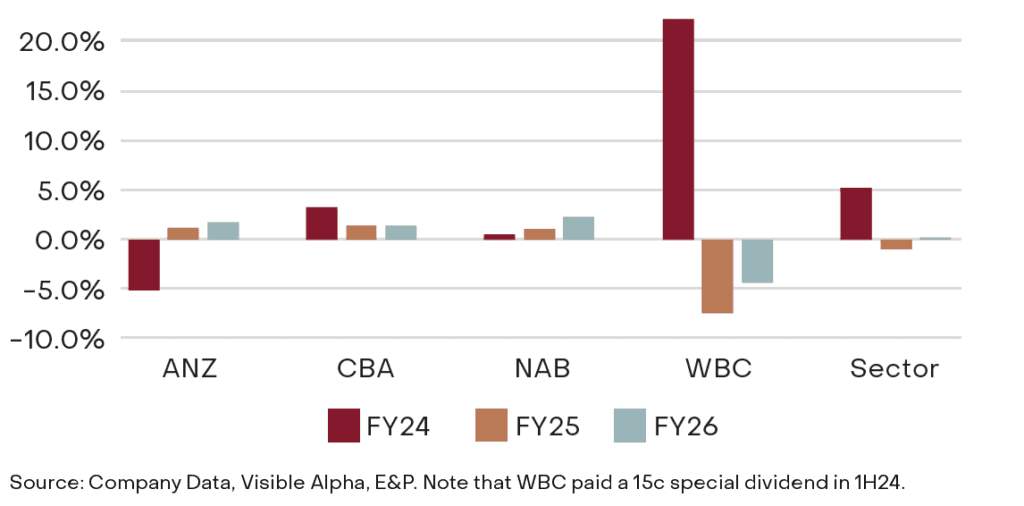

abnormally low bad debt costs given low unemployment, the residual benefits of the significant economic stimuli and the impact of share buybacks given comfortable capital levels. Despite this, we think longer term investors should be focused on full valuation levels, the lack of dividend growth in FY25e and FY26e and the risk that benign credit conditions worsen and generate downside risk to earnings and dividend estimates.

Bank Sector Dividend Growth Forecasts

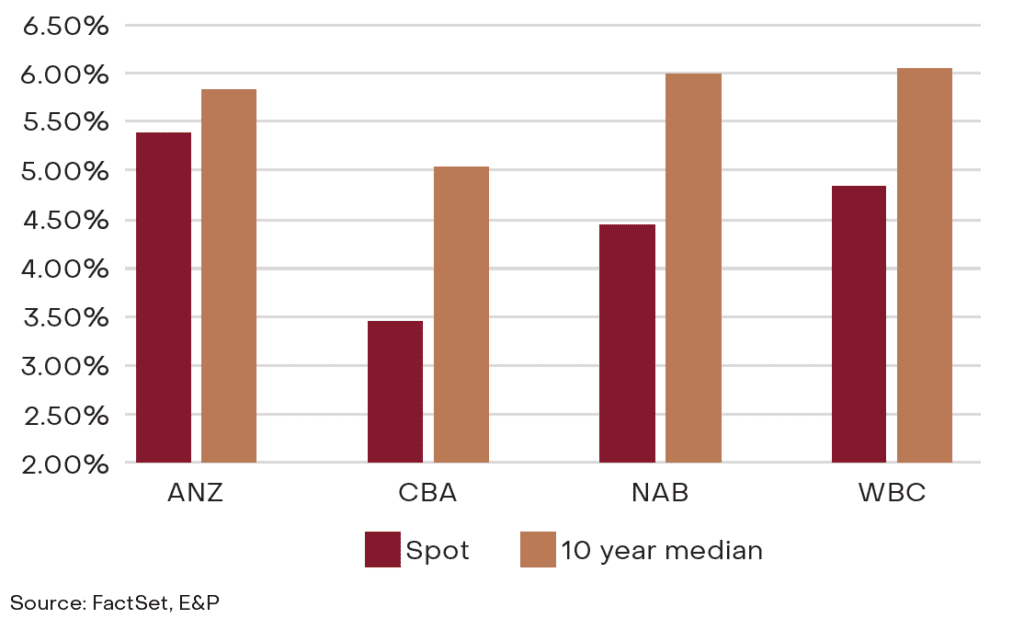

Whilst we acknowledge that the Big 4 banks have been the bedrock of domestic investors’ portfolios for decades, we currently see greater relative value in increasing exposure to interest rate securities, particularly floating rate credit opportunities. For investors seeking income from their Australian equity allocation, we see greater total return potential in APA, ARF, QAN & TLS, all of which are on our E&P Direct Equity Recommendations list.

Bank Sector Dividend Yields vs 10 Year Median

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.