Federal Budget 2025 Summary

The big picture

Treasurer Jim Chalmers has unveiled his fourth federal budget, with a continued emphasis on cost-of-living relief. This budget lays the groundwork for a potential federal election, with the final direction of certain proposals likely hinging on its outcome.

While many measures aim to alleviate cost-of-living pressures, they also present both opportunities and risks for investors. Notably, changes to superannuation taxation demand careful consideration.

As anticipated, the budget forecasts a significant deficit, reflecting the Government’s focus on fostering economic stability and growth.

Superannuation

Additional tax on balances over $3 million

The draft legislation is before the Senate. The 2025-26 Budget papers were silent on the future of this measure but if enacted, would involve an additional 15% tax applied to earnings on superannuation balances exceeding $3 million, will take effect from 1 July 2025.

With only a few months to go, individuals and couples should start planning now. Link to insight here.

Superannuation guarantee

- Additional Tax for Balances Over $3 Million: Pending Senate approval, this measure would apply an additional 15% tax on earnings for superannuation balances exceeding $3 million, effective July 1, 2025. Individuals and couples are encouraged to plan accordingly.

- Superannuation Guarantee Payments: From July 1, 2026, employers must align superannuation payments with salary or wage payments, replacing quarterly due dates. Guarantee contributions will increase to 12% as legislated, while concessional contribution caps remain unchanged at $30,000.

- Paid Parental Leave Superannuation: Starting July 1, 2025, superannuation guarantee payments will apply to Government-funded Paid Parental Leave (PPL). This coincides with the gradual increase of PPL to 26 weeks by July 2026. These changes aim to address retirement savings gaps for caregivers.

Tax

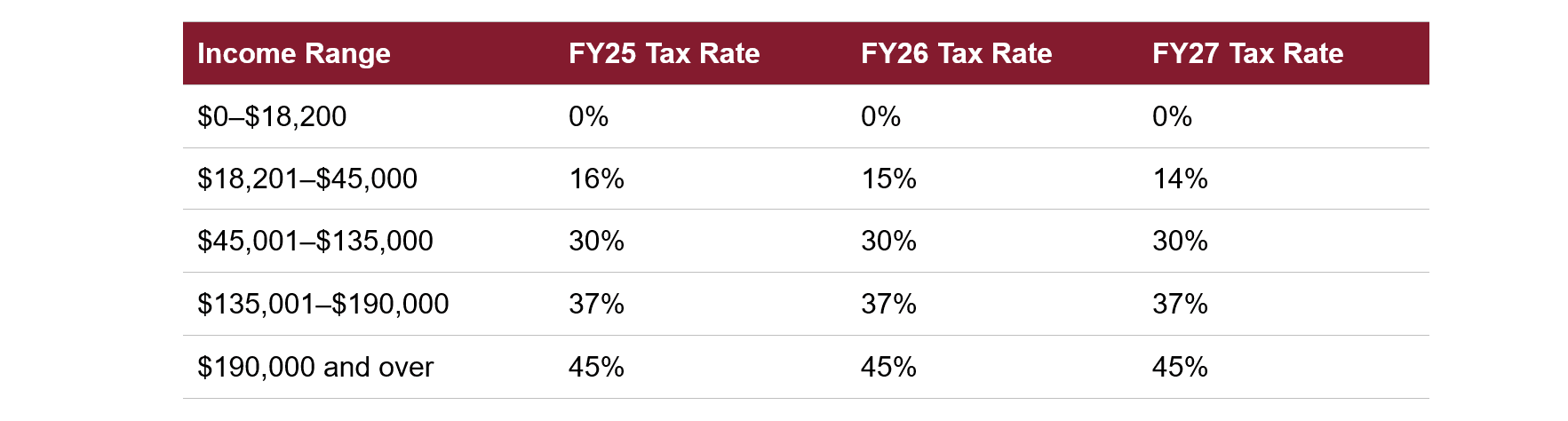

The government has announced modest tax cuts starting July 1, 2026, impacting everyone earning above $18,200:

- Income between $18,201 and $45,000: Tax rate reduced from 16% to 15% in 2026 and further to 14% from July 1, 2027.

- Expected savings: $268 in the first year, increasing to $536 in the second year. Other tax brackets and rates remain unchanged:

(Rates exclude the Medicare levy of 2%.)

The Medicare Levy income threshold will be raised, exempting more taxpayers or reducing the levy for those eligible.

Cost of living relief

Energy Rebates: Beginning July 1, households and approximately one million small businesses will receive $150 quarterly energy rebates, extended from previous relief programs, costing $1.8 billion over forward estimates.

Healthcare Initiatives:

- 8 million additional bulk-billed GP visits annually, supported by investments in scholarships and new GP trainees.

- Medicare payment increases based on location (e.g., $42.85 to $86.91 for standard consultations).

- 50 new urgent care clinics to enhance accessibility, with 80% of Australians living within a 20-minute radius.

- Cheaper medications via reduced Pharmaceutical Benefits Scheme (PBS) costs, saving Australians $200 million annually.

Education & Housing

- HECS-HELP Debt Reduction: A 20% reduction on average debts, easing financial pressures for young Australians. Graduates with $27,600 debt will see $5,520 removed from their loans.

- Help to Buy Scheme: Broadened to allow property co-ownership with the government, reducing deposit and mortgage amounts required for homeownership. The government may hold a 30-40% stake, which homeowners can gradually buy out.

Childcare

- Guaranteed three days of subsidised childcare per week starting January 2026 for families earning up to $533,280, with the removal of activity test requirements.

- Enhanced Paid Parental Leave Flexibility: Families can now divide the leave entitlement to suit their needs, encouraging fathers to take on caregiving roles and enabling mothers to return to work sooner if desired.

Social security deeming rates

- Retirees benefiting from social security programs such as the Age Pension and Commonwealth Seniors Health Card will see current deeming rates maintained at 0.25% for the first $100,200 of financial assets, and 2.25% for balances exceeding this, through June 30, 2025.

Looking ahead

The 2025 budget reflects the government’s continued focus on balancing cost-of-living relief with fiscal responsibility while laying foundations for future economic stability and growth. As several measures depend on election outcomes, individuals and businesses should remain vigilant to adapt their financial strategies accordingly.

References

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.