Broadening Horizons

While the outlook for global markets is trending positive, the evolving mix of opportunities and risks mean diversification remains key and asset allocation should be reviewed to reflect this new landscape.

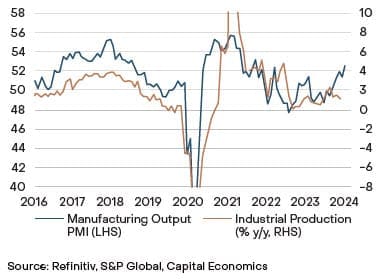

Global conditions are improving. For the past two years, the narrowness of market returns has reflected the narrowness of economic growth. The only bright spot has been US consumer spending with other regions and sectors under some pressure. This looks to be changing. The industrial sector is showing signs of life and conditions outside the US are starting to catch up.

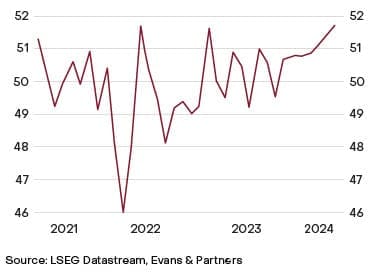

Risks are fading in China. Aggressive government action is limiting the damage from the property downturn and exports are strong again, due primarily to electric vehicles and batteries. Households are still not spending, however, and this needs to change to improve longer-term prospects.

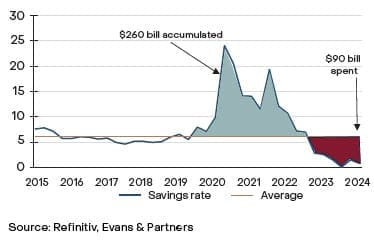

The Australian economy has been stagnant because of high interest rates and cost of living pressures. A surge in immigration probably prevented a recession. There is hope for some improvement now with tax cuts implemented, high accumulated savings, rising wealth and a healthy labour market but the timing and extent of a spending recovery is unclear.

The other good news is that the inflation crisis is largely over. However, inflation will be persistent to some extent and this points to bond yields and official interest rates remaining above pre-COVID levels. This is important for asset allocation given the higher returns on offer in cash, credit and government bonds.

Lingering risks

While this is generally a positive backdrop, we are watching a number of lingering risks. Inflation could resurge and geopolitical risks remain elevated. The particular political risks this year are from elections. The Indian, Mexican and French elections have already caused some volatility and more is likely as the US election approaches.

Asset allocation needs to reflect the changing macro landscape, the material change in interest rates and the elevated risk environment. Diversification is the best way to protect against country-specific election risks. We have also been adding exposure to interest rate securities where potential returns have increased significantly.

Equities priced for positive outcome

The better macro and profit outlook is a positive for equity markets. The complication, however, is that stock prices have moved ahead of the macro and are already priced for a positive outcome. This has been particularly the case for the US tech sector. Investors need to be selective and we recommend positioning via rotation into sectors that will benefit from the broadening in the global recovery. Small companies, emerging markets and selected commodity producers stand out.

Global Industrial Production & Manufacturing Output PMI

China Manufacturing PMI

Australian excess savings %

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.