Bank of Mum and Dad: The ripple effect of gifting to the next generation this Christmas

The “Bank of Mum and Dad” has become a vital financial resource for younger generations in helping them achieve major life milestones. According to the Finder Wealth Building Report 2024, 34% of Australian parents have bought investments on behalf of their offspring, with approximately a third of these gifts given in lieu of presents during special occasions such as Christmas. While financial support from parents and broader family members (e.g., grandparents) is increasingly commonplace, using superannuation is less so. Gifting to the next generation in this way is not just an act of generosity with potential tax benefits for recipients, but an investment in their future.

Immediate benefit, lasting impact

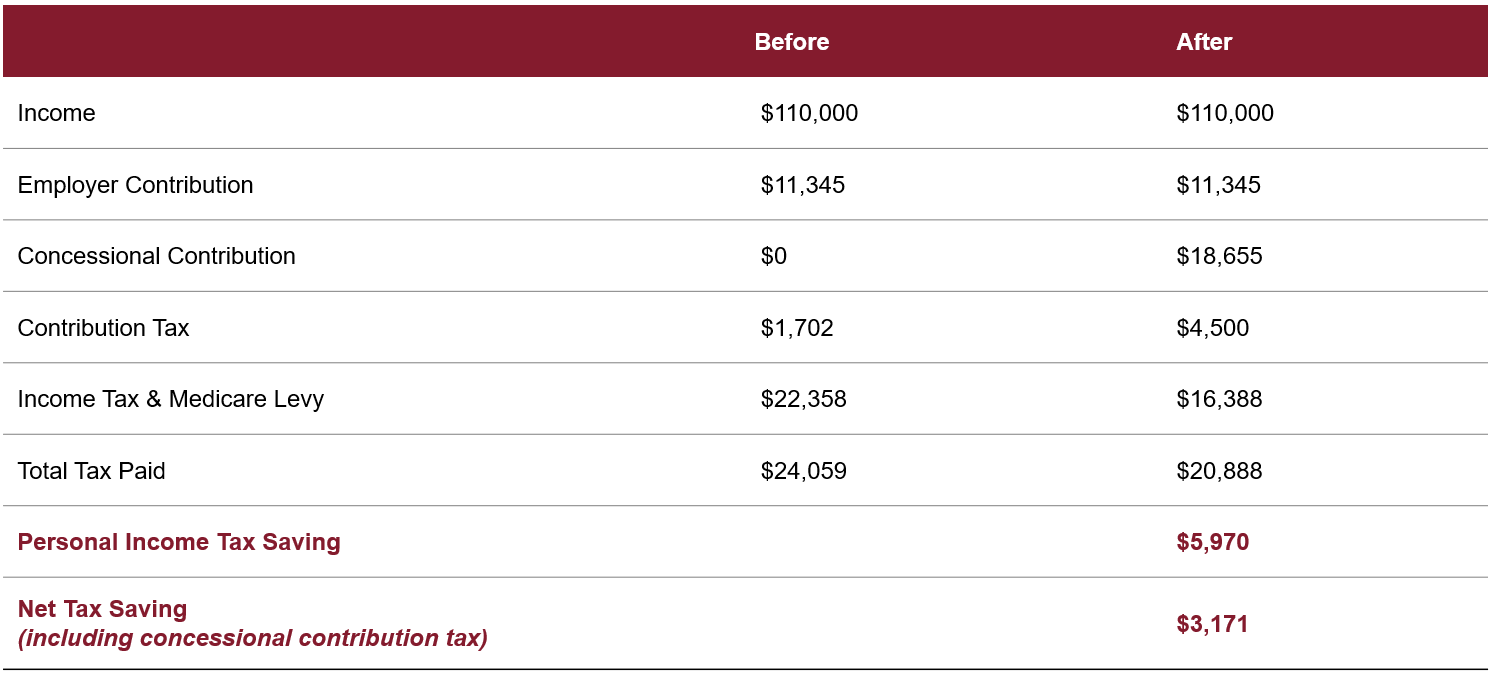

While superannuation is predominantly viewed as a tool for long-term retirement savings, a concessional contribution can also deliver immediate financial relief.

Typically, concessional contributions are those that are paid by employers via the superannuation guarantee or salary sacrifice arrangements. These contributions provide tax savings for the recipient while also boosting their retirement nest egg. The same outcome can be achieved via a concessional contribution into superannuation from one’s bank account.

Eliza works as an office administrator and earns $110,000 per annum, which includes a mandated employer superannuation contribution of $11,345. Eliza receives a gift from her grandparents of $20,000 and contributes up to her annual limit of $30,000 (i.e., a contribution of $18,655). This act reduces her personal tax, which may result in a tax refund of close to $6,000 while increasing her superannuation savings. For gifting family members, this tax benefit can provide a meaningful difference to recipients in funding regular cost-of-living expenses.

A gift that grows

Superannuation is a powerful tool for long-term wealth building, thanks to its favourable tax structure. The tax paid on investment earnings is at most 15%, which is lower than tax rates outside of superannuation, which can reach as high as 47% (including the Medicare levy). A gift that allows your offspring the opportunity to leverage their superannuation over the long-term has the potential to meaningfully improve their financial position.

The gift provided by Eliza’s grandparents not only provides a tax benefit, but it can also continue to grow tax-effectively, such that the benefit to Eliza by the time she retires could be seven times the initial gift, at $142,000. Upon retirement, Eliza may also be eligible to withdraw these funds from superannuation tax-free (see here for further details).

Eliza’s investment outcomes are shown below. To help investors visualise their own potential investment trajectory, we have created a compound interest calculator, which can be accessed here.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of entry or investment size of holdings.

Leaving a legacy

While providing financial assistance is a generous act, it can have unintended impacts on your financial position, security, and retirement plans. For this reason, it is important to consider your own needs and how these may change over time (e.g., rising living costs, aged care needs etc.). For those receiving government benefits, there are also restrictions on gifting that should be considered.

Importantly, financial assistance does not always require a monetary transaction. For many families, assistance may involve:

- Education: Passing on lessons learned, and resources used is an effective way of instilling healthy budgeting, investing, and financial goal-setting habits. We encourage clients to bring their broader families to meetings with their advisers to help facilitate this.

- Integrated strategies: There are a range of financial planning strategies that can be used to help build and protect intergenerational wealth (e.g., a withdrawal and recontribution strategy).

- Inheritance management: Discussing inheritance plans openly helps prevent future conflicts, aligns expectations, and allows beneficiaries to understand the rationale behind financial decisions.

Overview

The gift of a superannuation contribution offers the dual benefit of providing immediate support to children through tax savings while also encouraging disciplined wealth accumulation. Whether your assistance is financial or intangible, there are various ways to support your beneficiaries. An Evans and Partners financial adviser can help outline the considerations for you while also illustrating the benefits for your loved ones.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

The information contains projections and forecasts (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group and its related entities make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. Results are only estimates, the actual amounts may be higher or lower. We cannot predict things that will affect your decision, such as changing interest rates. Seeking professional personal advice is highly recommended before acting on any such assumptions. Past performance is not a reliable indicator of future performance.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.