Bank of Mum and Dad: Helping the Next Generation Build Wealth Wisely

For many investors with surplus income, providing financial support to their children can be a meaningful way to pass down wealth early while ensuring their children use it wisely.

This concept, often called the “Bank of Mum and Dad”, has become a crucial financial lifeline for younger generations facing high property prices and increasing living costs. However, parents must approach financial gifting strategically to ensure it benefits their children in the long term while protecting their own financial security.

While it is common to see parents directly gifting to children to help purchase a first home or pay down a mortgage, it’s a lesser-known strategy that parents can help children build wealth through super. The tax concessions available through superannuation and the fact that contributions are locked away until at least age 60, makes superannuation a very attractive investment vehicle for parents to financially assist their children.

Immediate savings for lasting benefits

While there are various ways to contribute to superannuation, personal concessional contributions often provide the best value for most individuals. The annual concessional contribution cap is $30,000 per year. However, if your total super balance was below $500,000 as of June 30, 2024, you may be eligible to carry forward any unused concessional contributions from the past five financial years.

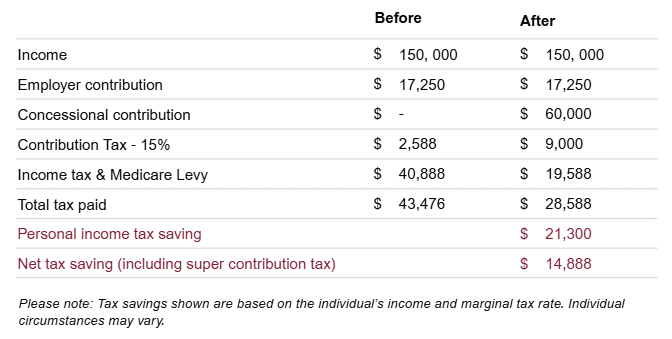

Consider the example of Sophia, a 50-year old accountant earning $150,000 per year. Her employer contributes the mandatory 11.5% to her super fund. With a total super balance of $470,000, she checks her myGov account and confirms she has $47,250 in unused concessional contributions available to carry forward, in addition to the current financial year’s cap.

Her retired parents, Bill and Sue, decide to gift her $60,000, which she uses to maximise her concessional contributions.

As a result, Sophia benefits from a significant tax saving – receiving a welcome refund in her tax return – while also boosting her superannuation by $51,000 in a single year.

A gift that grows

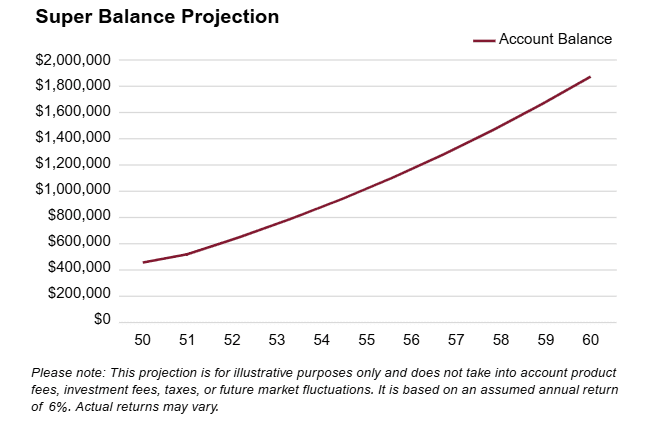

Although Sophia’s total super balance will exceed $500,000 after this year’s concessional contributions, she can still make personal concessional contributions up to the annual cap of $30,000 in future financial years.

This means if Bill and Sue continue gifting Sophia $60,000 each year, she can use it to maximise her concessional contributions, with any remaining amount contributed as a non-concessional contribution.

Beyond the personal tax saving of $5,000 each year, this strategy allows Sophia to invest and grow her super tax-effectively. As a result, if she retires at 60, her super balance could reach $1.86 million.

Upon retirement, Sophia may withdraw a tax-free income from her super balance which could help fund a very comfortable retirement while also providing flexibility to access capital if required.

Final Thoughts: A Balanced Approach

Many parents are eager to support their children financially, but it’s essential to balance generosity with long-term financial security. Retirees should seek financial and legal advice before making significant gifts or investments to safeguard their own well-being. When approached strategically, the “Bank of Mum and Dad” can empower the next generation to become self-sufficient and, most importantly, financially secure.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.