Appetite for Yield – Opportunities in Credit Markets

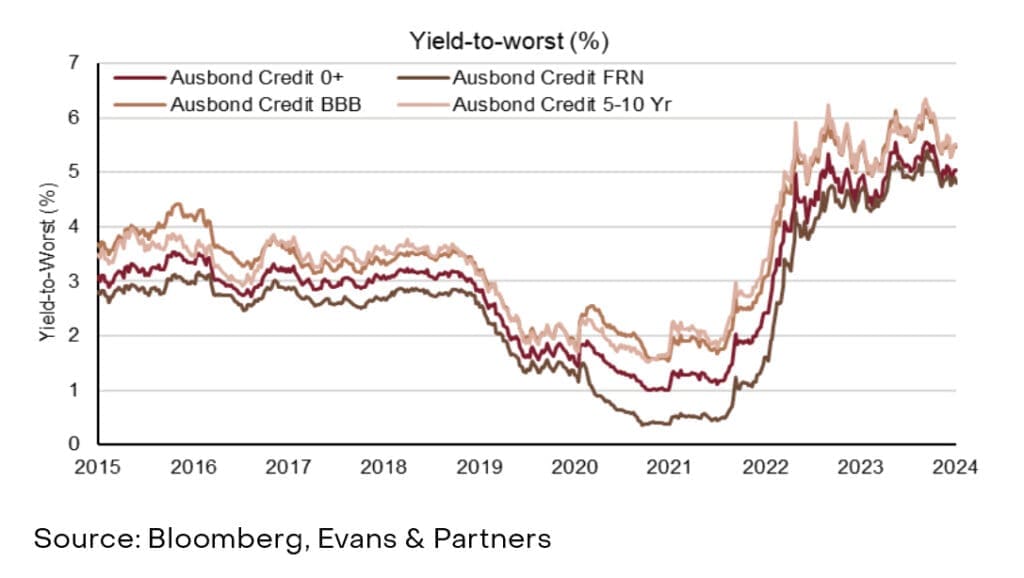

Interest rate securities remains our preferred asset class from a risk-reward perspective. High starting points for yields, reasonable valuations in credit and a supportive monetary policy backdrop bodes well for fixed income investors.

Preference for domestic

Within the asset class, we have a preference for domestic credit exposures which continue to perform well against a backdrop of rising interest rates, economic stability and solid corporate fundamentals. Primary markets have had no issues absorbing a spike in issuance. Recent debt offerings from corporates such as Telstra, Macquarie and Woolworths were each 3-4 times oversubscribed.

The level of demand highlights the appetite for yield, something we think is unlikely to conclude anytime soon. Large institutional investors such as superannuation funds are only now reaching historical allocations for fixed income after a prolonged period of suppressed interest rates.

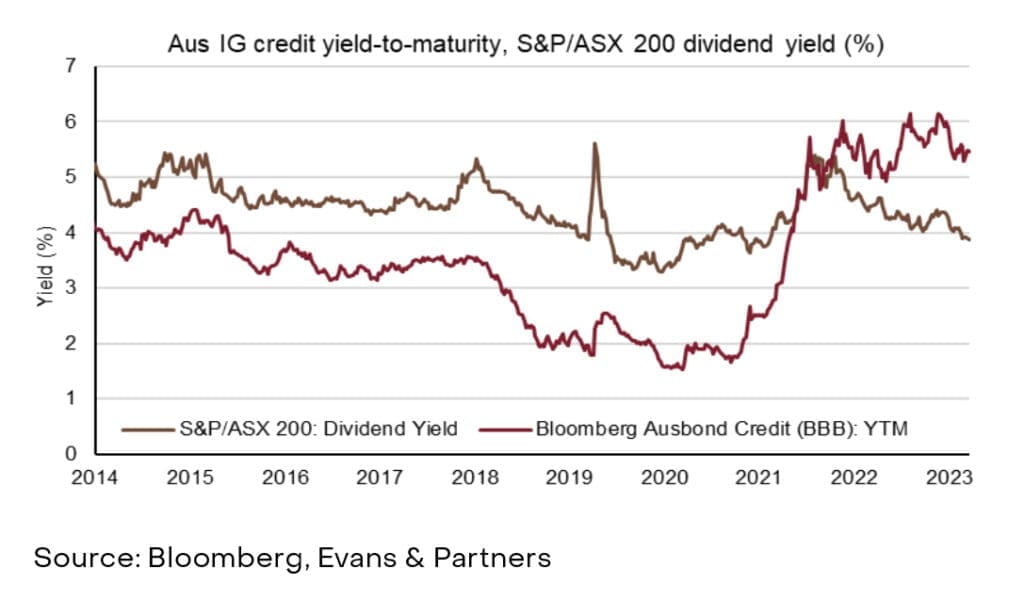

At the same time, the yield opportunity relative to equities remains compelling. Recent strength in the domestic equity market has seen the dividend yield for the Australian equity market fall to ~4%, its lowest level since the aftermath of the pandemic. This can be attributed to falling dividend forecasts in the materials sector thanks to the increasing capital intensity of the transition to ‘green metals’; while a steady flow of passive money into the region has sent banking sector valuations to cyclical highs. We see this as an increasingly opportune time to rotate lazy equity positions into high quality credit instruments with sustainable income yields of 6-7% p.a.

Global trends

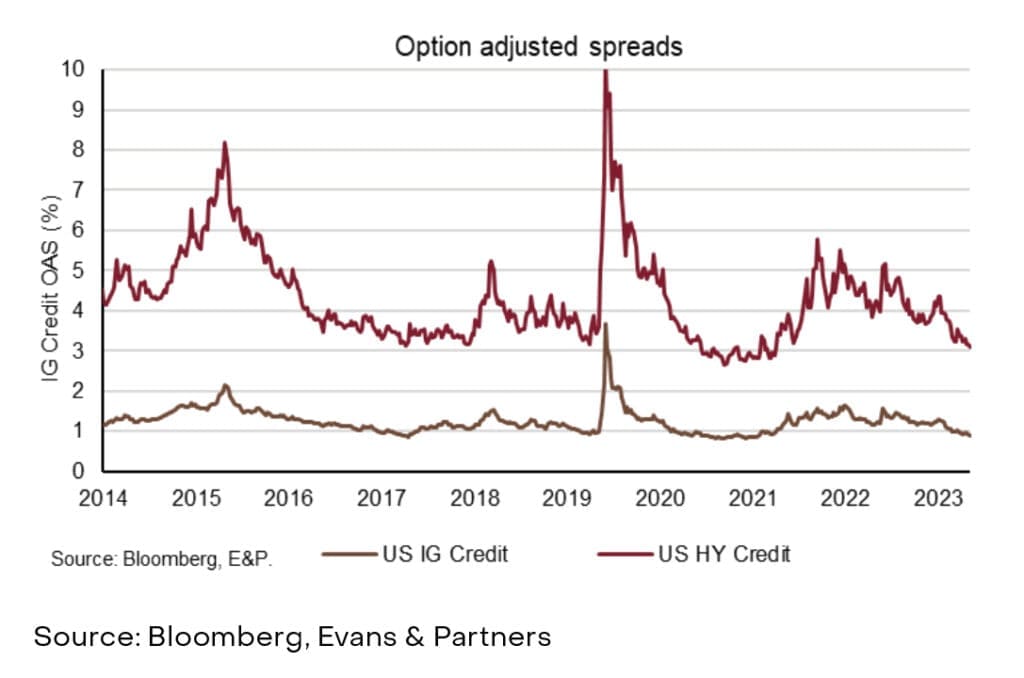

Within offshore markets, spreads (the difference in yield between credit instruments and government bonds) have tightened aggressively in recent months and now sit at their lowest levels since 2021. Investor enthusiasm for the asset class reflects the upbeat outlook for the US economy. This, in turn, bodes well for corporate earnings and balance sheets.

Credit quality remains healthy

Broad indicators of credit quality remain healthy, though we are starting to see some deterioration in fundamentals as the impact of higher interest costs and slowing economic growth take effect. To date however, this remains contained to the lowest quality segments of credit markets such as liquid loans and unrated credit. In addition, refinancing obligations are, in most cases, still 2-3 years away when interest costs are expected to be lower.

Duration matters

We remain reluctant to extend too much risk towards longer term securities such as government bonds due to lingering inflation risks and ongoing uncertainty around the timing of rate cuts. It is becoming increasingly clear that inflation may linger for longer than initially thought. This creates the potential for interest rates to stay ‘higher for longer’ and, in turn, place upward pressure on bond yields given the market’s expectations for rate cuts over the second half of the year.

Australian Credit Yields

Yield Premium

Credit Spreads: US Investment Grade and High Yield

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.