Tim Rocks

Chief Investment Officer

Tim Rocks

Chief Investment OfficerTim joined Evans and Partners in 2017 as Chief Investment Officer and has more than 25 years’ experience as an investment strategist, head of research and fund manager in Australia and Asia.

Initially commencing his career at the Reserve Bank as an economist, Tim then joined Macquarie Group where he spent five years covering the Australian equity market as a strategist. He then moved with Macquarie to Hong Kong where he built and ran their Asian macro research group.

Prior to his current role Tim was Head of Market Research and Strategy for BT Financial Group and ran asset allocation for Westpac’s $30 billion Superannuation Fund.

He has a Bachelor of Economics (First Class Honours) from the University of Sydney and a Masters’ in Finance from the London Business School.

Recent Insights from Tim Rocks

View all Insights

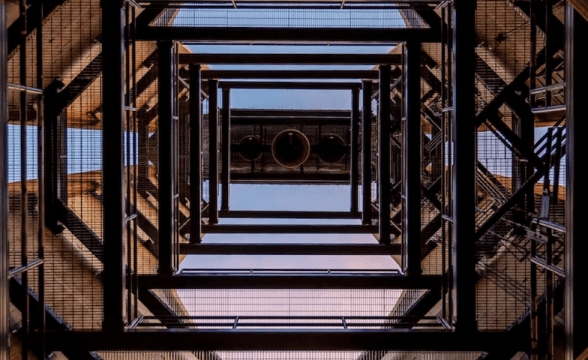

Unlisted Infrastructures Growing Appeal

As inflationary risks continue to be top of mind, there is an investment option which can offer some protection and still deliver attractive returns. We take a closer look at the asset class and the recent developments that have contributed to its growing appeal.

Separating the 'Haves' and 'Have Nots' in Small Caps?

The global sell-off in equities may have hit the small cap market hard ― particularly growth and technology stocks ― but for investors, the lure of the faster growth rates on offer in the sector remains.

Attention Turns to Fixed Rate Bonds

Longer-term fixed rate bonds have not been an attractive investment for some years. The interest rate on these bonds was extremely low and there was the risk of capital returns if rates rose. However, interest rates have now reset higher which makes government bonds a much more attractive proposition.

What is inflation and why it matters

Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of the prices within the consumer price index, i.e., a specific ‘basket’ of goods and services weighted by spending patterns in the economy.

The Quest for Quality & How to Find It

When contemplating which stocks to buy, there are several different ways to break up the market. Companies can be segregated by country or sector, but we can also look at their particular attributes. We look at why investing in ‘quality’ is worth considering in the current environment.

Differentiating A Bear Market From A Market Correction

In the jargon of financial markets a “correction” in a stock index is defined as a fall of 10 per cent and a “bear market” is a fall of 20 per cent. This correction is measured from the most recent peak in the market.

Could Small Caps Could Benefit From a Market Bounce?

Valuations for the Australian small cap sector have recently fallen close to decade lows and could provide opportunities for investors to buy-in. We take a closer look at the market and some of the factors to consider.

Big Wealth Transfer & Family Offices Appeal

With significant levels of family wealth set to change hands over the coming years, many high-net-worth families are opting to manage the transition by turning to a specialist family office service provider. We look at some of the benefits this service can deliver.

Explainer: What is a recession?

As more commentators talk about a potential recession, investors should understand what a recession is, how common they are, and why it is important to remember that not every recession leads to a crisis.

Explainer: Bonds Versus hybrids

This article explains the different roles played by bonds and hybrids in the fixed income category, in the context of the current investment environment.

Global Assets Vs Australian Assets.

Most Australian investors still have too much exposure to Australian assets. This article looks at some of the reasons why and the role global assets can play in diversifying portfolios.

Silver Linings in the New World

It might not feel like it, but the investing environment is better now than two years ago.

Recession Refresher

Financial strains are rising, yet the Federal Reserve remains more concerned about the medium-term implications of high inflation than the potential damage to the financial system.

Watching Financial Strains

After several small bank failures, pressures have recently emerged in the US financial system.

New Dawn for Small Caps

Many risks are still facing the US market, but this valuation cushion provides some protection for small caps in the short term and points to the potential for strong gains once there is more clarity on the outlook.

The Reasons for REITs

Despite the forecast of rising interest rates, Australian Real Estate Investment Trusts (REITs) currently stand out as an attractive sector with COVID recoveries not yet priced in. This is one of the reasons why now could provide an opportunity for investors looking to get exposure to property.

Watching Commercial Property

The potential for financial strains within the commercial property market remains a key macro risk.

Emerging Markets and Small Companies Stand Out

Equities have experienced remarkably strong returns since October 2023 when investors started to consider interest rate cuts by the US Federal Reserve.

Infrastructure in Focus

Attractive dynamics in unlisted infrastructure assets make them a compelling proposition for investors looking to add a defensive component to a well-diversified portfolio.

Federal Budget 2024 – Implications For Markets

Our wealth management research team identify the key issues for markets and the economy.

Market Update: Navigating China's Economic Landscape

Tim Rocks and Dr Joseph Lai from Ox Capital discuss the outlook for the Chinese stock market.

Market Update: Outlook for Commodity Markets

Tim Rocks speaks to Vivek Dhar from CBA about the outlook for commodity markets with a particular focus on China and iron ore.

Broadening Horizons

The outlook for global markets is trending positive but with an evolving mix of opportunities and risks.

Supercycle a Step Closer

Significant structural imbalances appear to be building the foundations of another commodities supercycle.

Market Update: US Election and Inflation Outlook

David Hay speaks to Tim Rocks about the increasing likelihood of a Trump victory in November and what that is likely to mean for markets and economies. They also discuss the inflation outlook, their expectations regarding US interest rates and what that will mean for currencies.

Broadening horizons

With inflation easing and interest rates falling, global markets are poised for solid returns, but investors must remain vigilant and adjust their asset allocation strategy to reflect the changing macro environment.Words on the US Election

Words on Trump's Agenda

Words on a Big Year Ahead

Words on Trump's First Fortnight

Words on Opportunities in Uncertainty